Since 1st January 2019, the Italian government requires a specific standard for all the companies that sell goods online. All of them are required to issue an electronic invoice for each order and to provide the Italian Agenzia delle Entrate with all invoices in a specific format.

This plugin includes a section that has been specifically developed to give Italian companies an easy tool to generate this required file, together with the PDF file.

If your company is based in Italy and if you sell online, you will be required an .xml file for every order placed in your online shop.

This plugin will help you do that the right way and without much trouble.

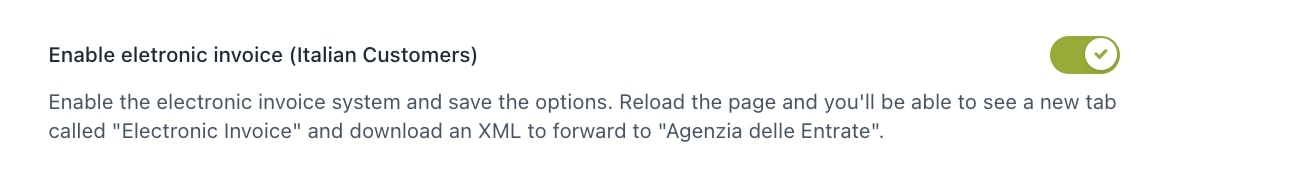

Go to the plugin settings at YITH > PDF Invoices & Packing Slips > General Options > Invoice options and enable the option called Abilita la fatturazione elettronica (clienti italiani)

Then, save the changes. After enabling the option, you’ll see the tab in the plugin called Fatturazione elettronica, where you can enter your company details so they will appear in the .XML file.

Specifically, you will be able to configure the following options:

- Impostazioni generali

- Impostazioni dettagli del soggetto o dell’azienda trasmittente

- Terzo intermediario

- Impostazioni Checkout

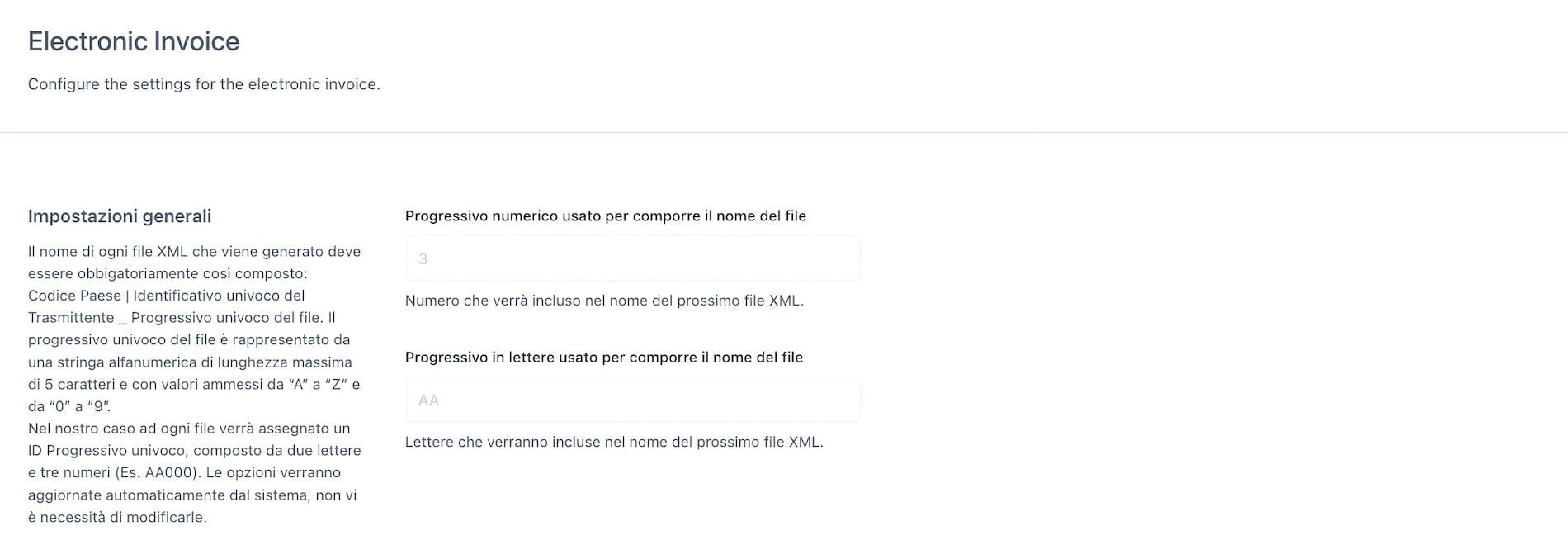

Impostazioni generali

The first section is about the file name format, which is made out of 5 characters, two letters and three numbers.

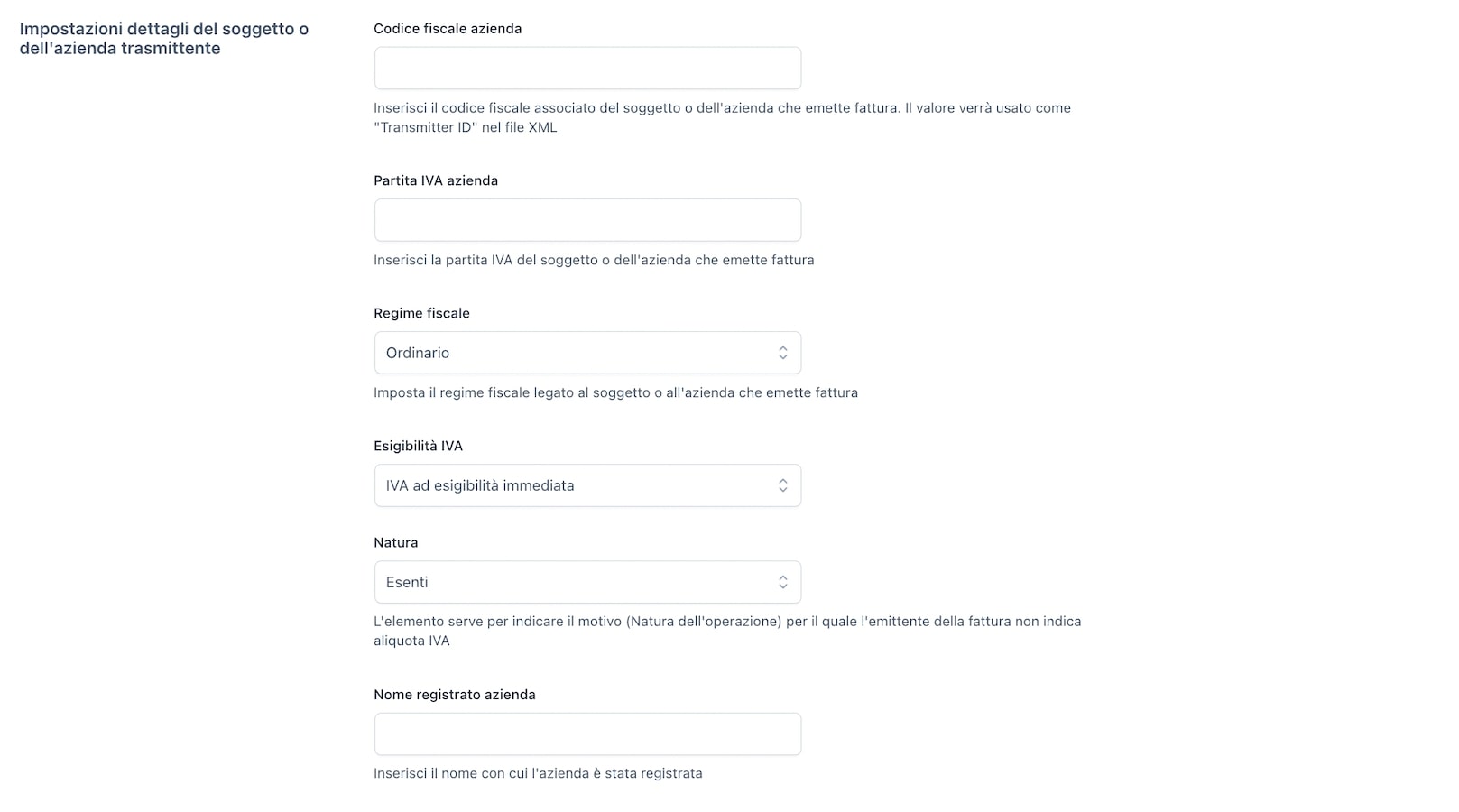

Soggetto o azienda trasmittente

Next, you find a section where you can enter all your details.

- Codice fiscale azienda

- Partita IVA azienda

- Regime Fiscale

- Esigibilità IVA

- Nome registrato azienda

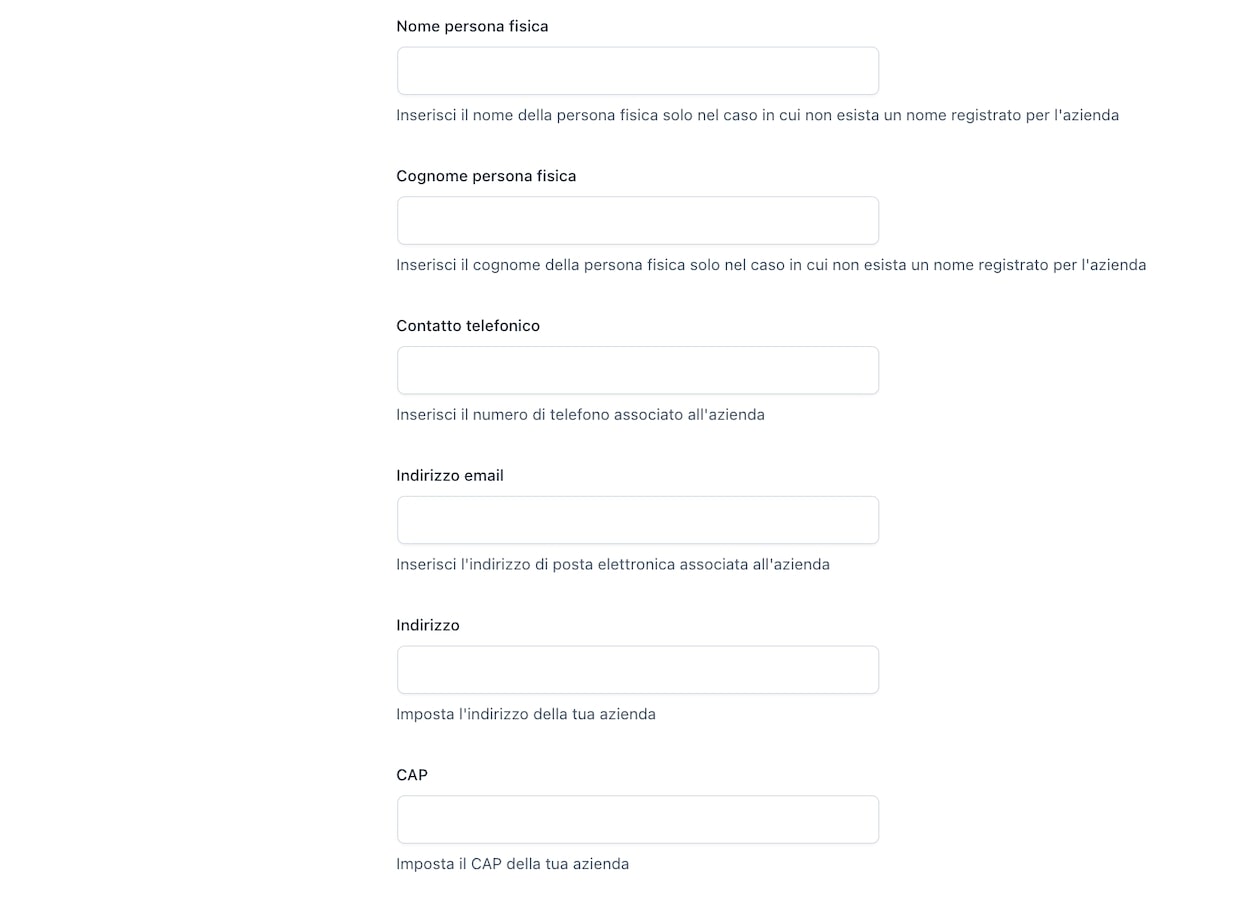

- Nome persona fisica

- Cognome persona fisica

- Contatto telefonico

- Indirizzo email

- Indirizzo

- CAP

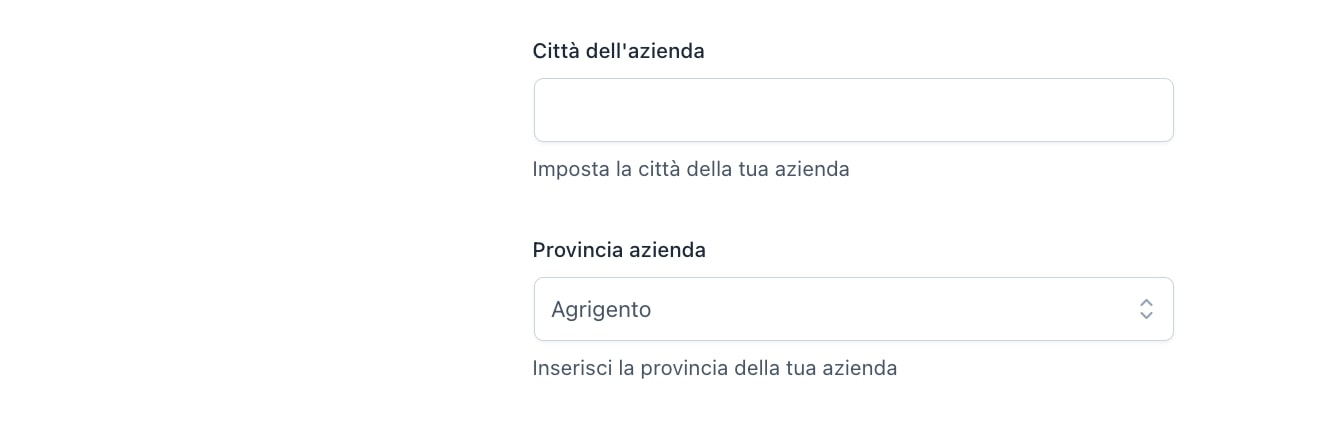

- Città dell’azienda

- Provincia azienda

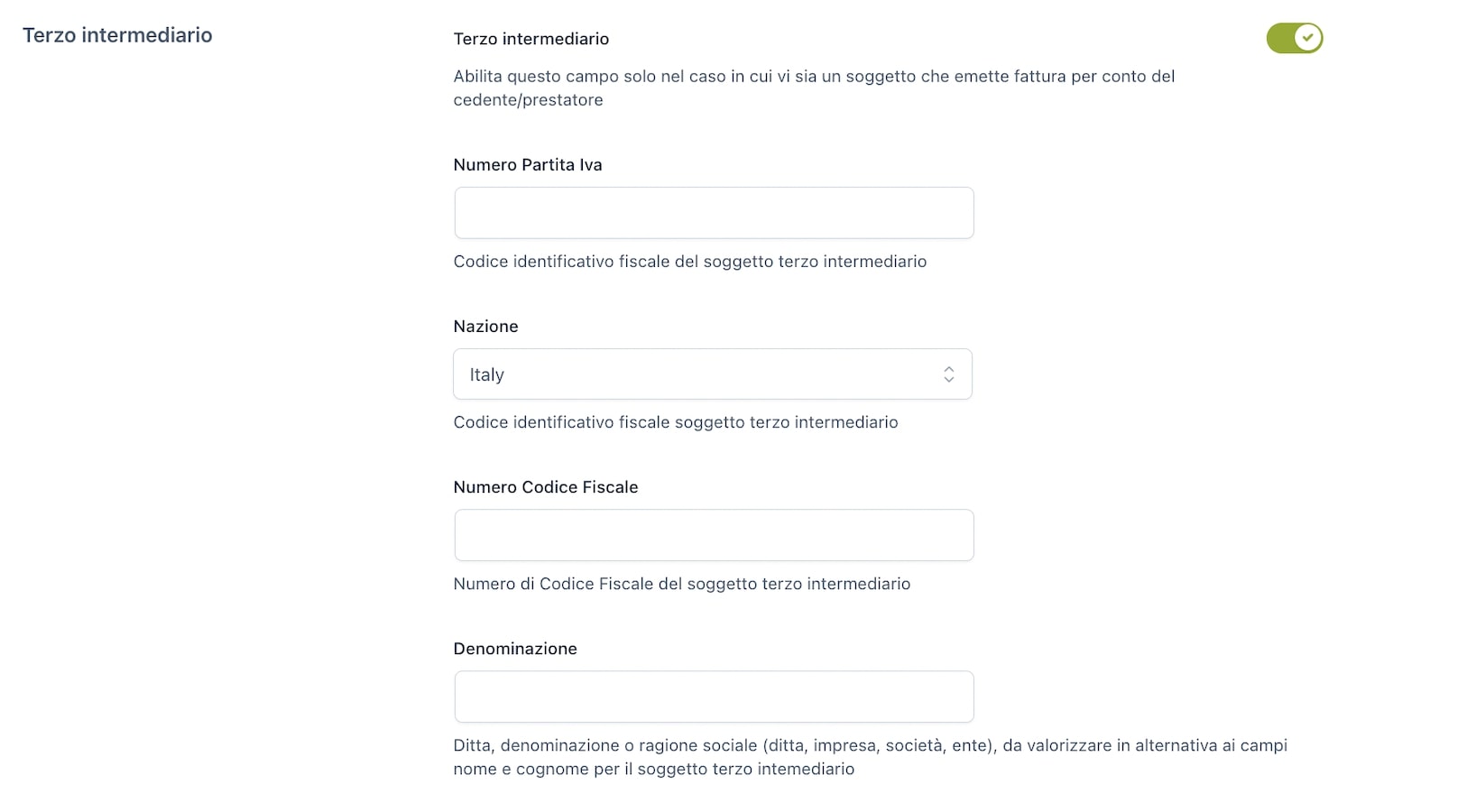

Terzo intermediario

In this section, it is possible to configure the details of a third-party company that is issuing the invoice, if applicable. You will be able to add the following details:

- Numero partita IVA

- Nazione

- Numero codice fiscale

- Denominazione

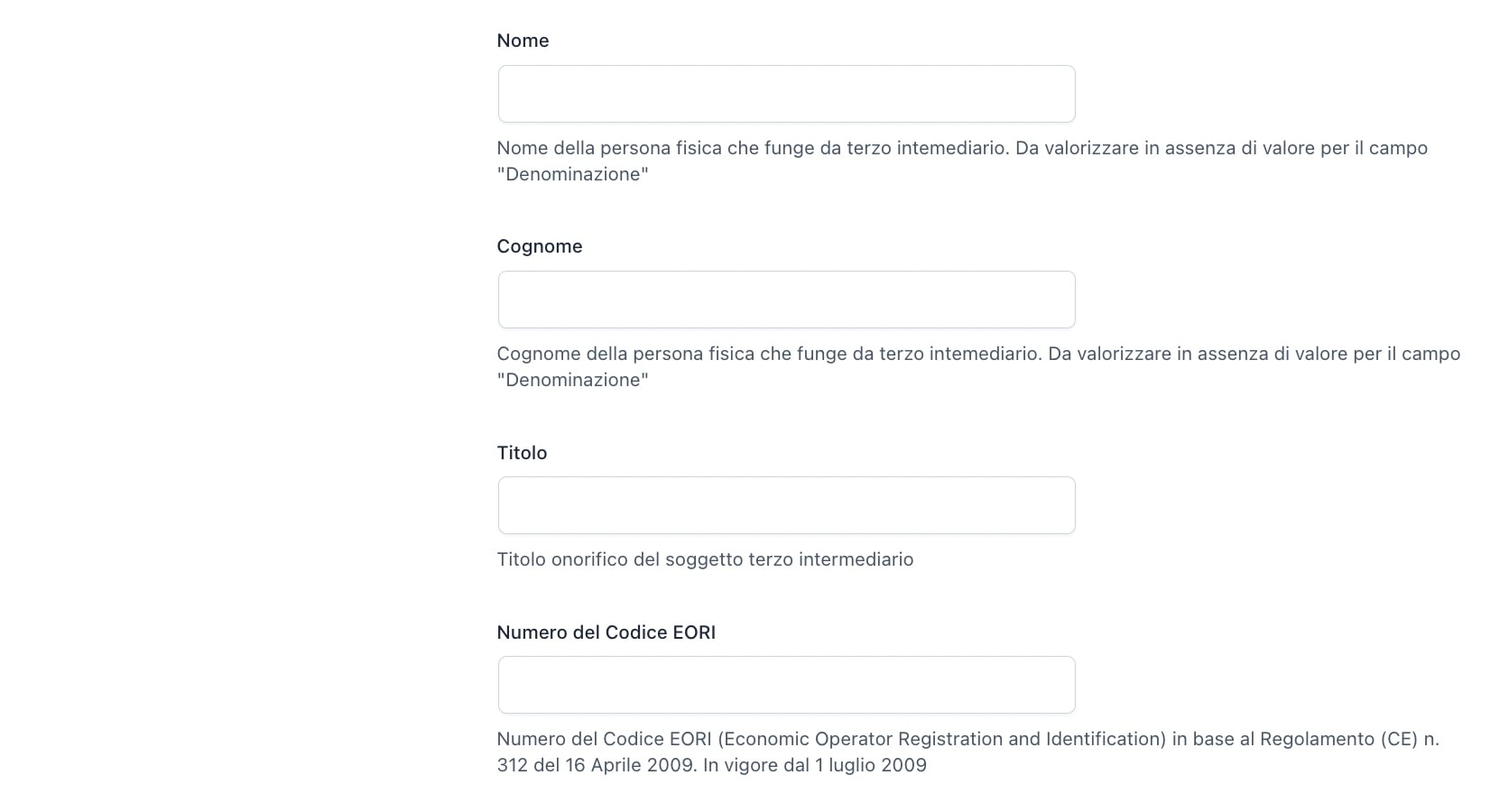

- Nome

- Cognome

- Titolo

- Numero del Codice EORI

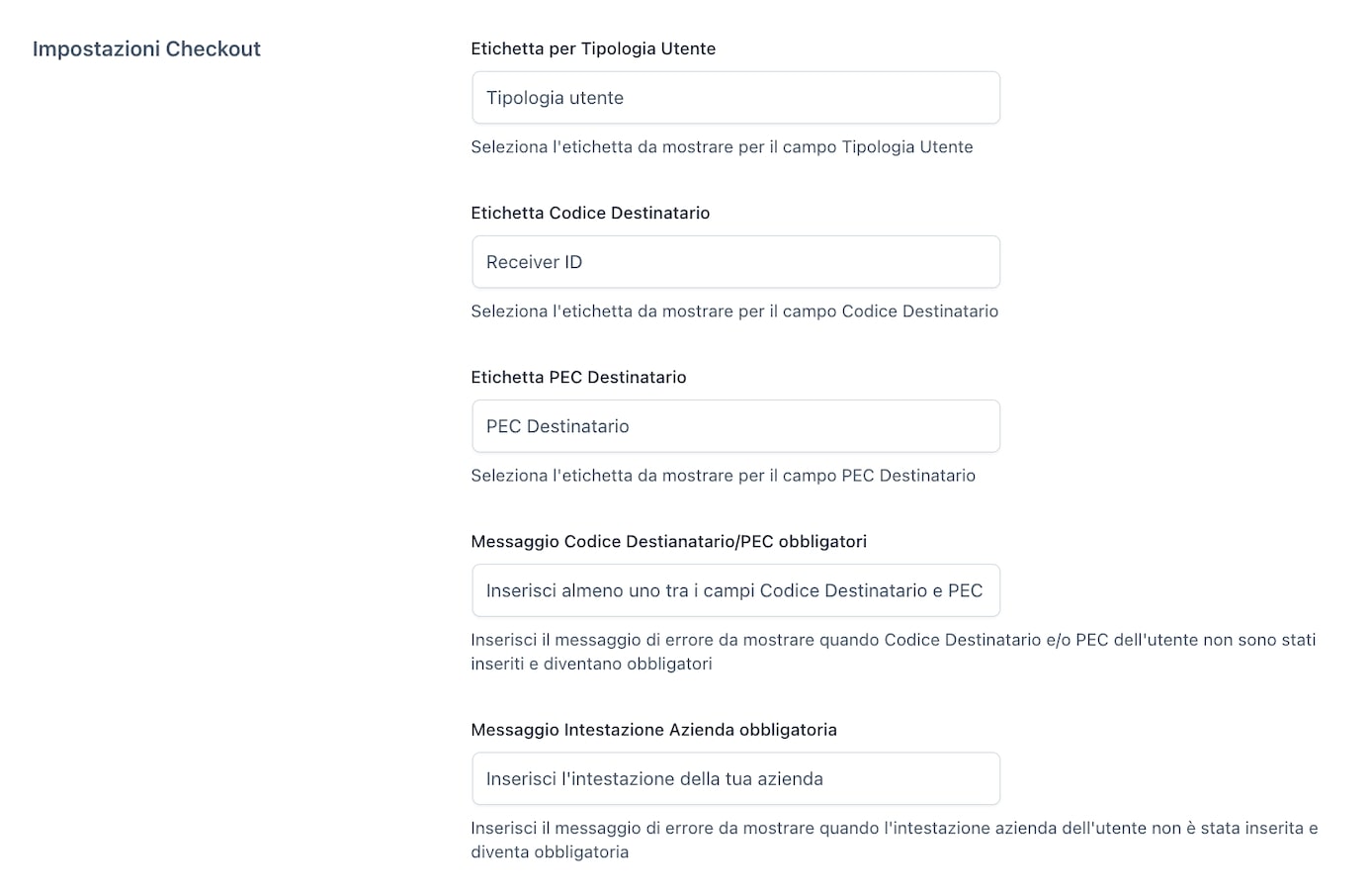

Impostazioni Checkout

In the last section, you can configure checkout options:

- Etichetta per tipologia utente

- Etichetta Codice Destinatario

- Etichetta PEC Destinatario

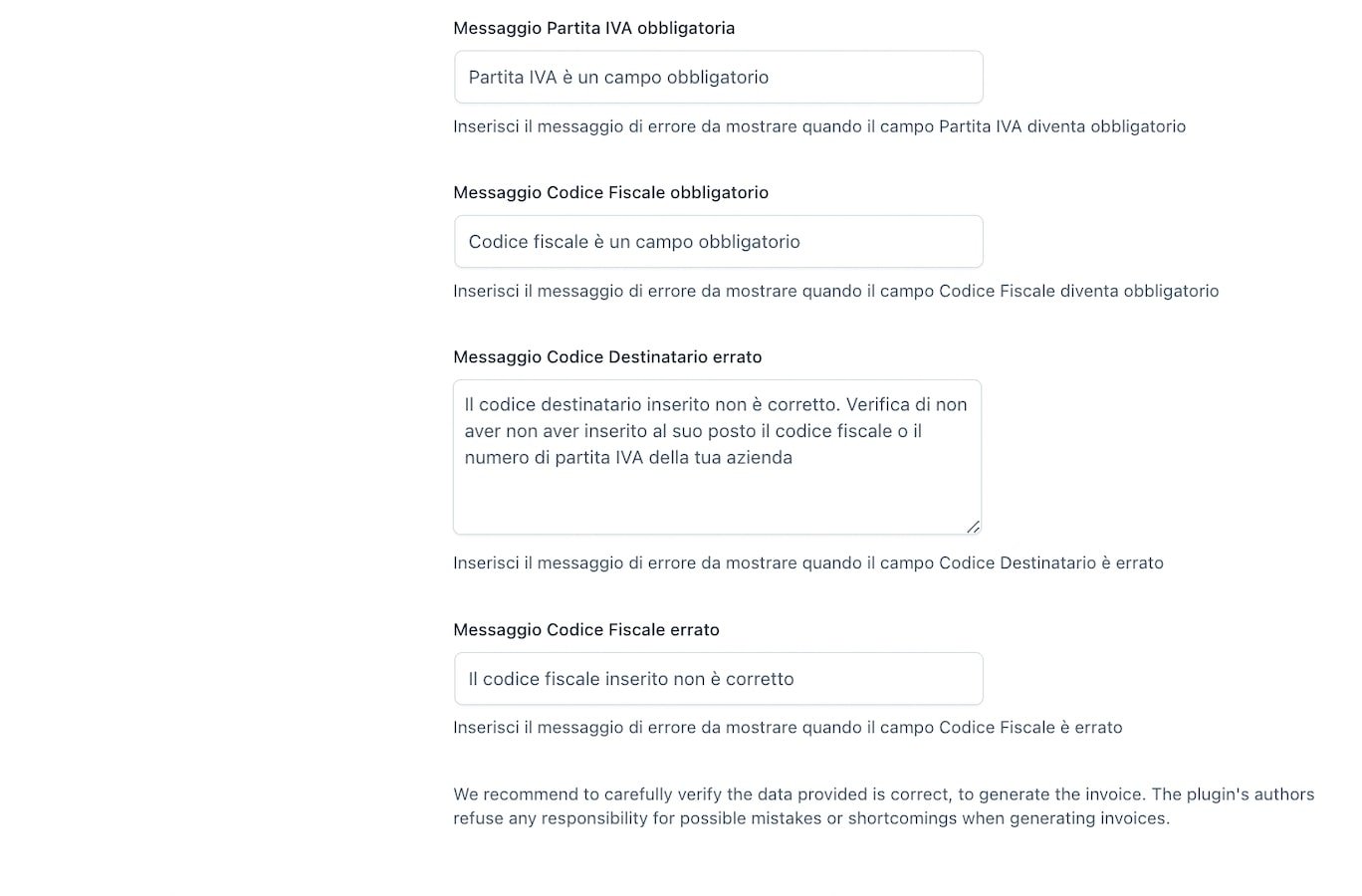

- Messaggio Codice Destinatario/PEC obbligatori: here you can enter a custom message to show whenever the receiver ID or the PEC email address is required.

- Messaggio Intestazione azienda obbligatoria: here you can enter a custom message to show when the company name is required.

- Messaggio Partita IVA obbligatoria: here you can enter a custom message to show whenever the VAT number is required.

- Messaggio Codice Fiscale obbligatorio: here you can enter a custom message to show whenever the Fiscal Code (SSN) is required.

- Messaggio Codice Destinatario errato: enter here a custom error message when the code validation returns an error.

- Messaggio Codice Fiscale errato: enter here a custom error message when the code validation returns an error.

Checkout page on the customer side

Whenever your customers are on the checkout page, they will be asked to fill in their details.

The plugin updates the checkout fields dynamically based on what the customer selects in the field Company Name: this way, whether the customer is a private entity or a company, they will be asked to fill in only the right information. Following you can see how it’s updated:

Italian company/freelancer:

-

Company/freelancer from other countries:

- Company VAT number is required for a company, optional for freelancers, but the extra fields will not show up

-

Italian private subject:

- Codice fiscale is required but the extra fields will not show up

Private customer from other countries:

- SSN number is optional

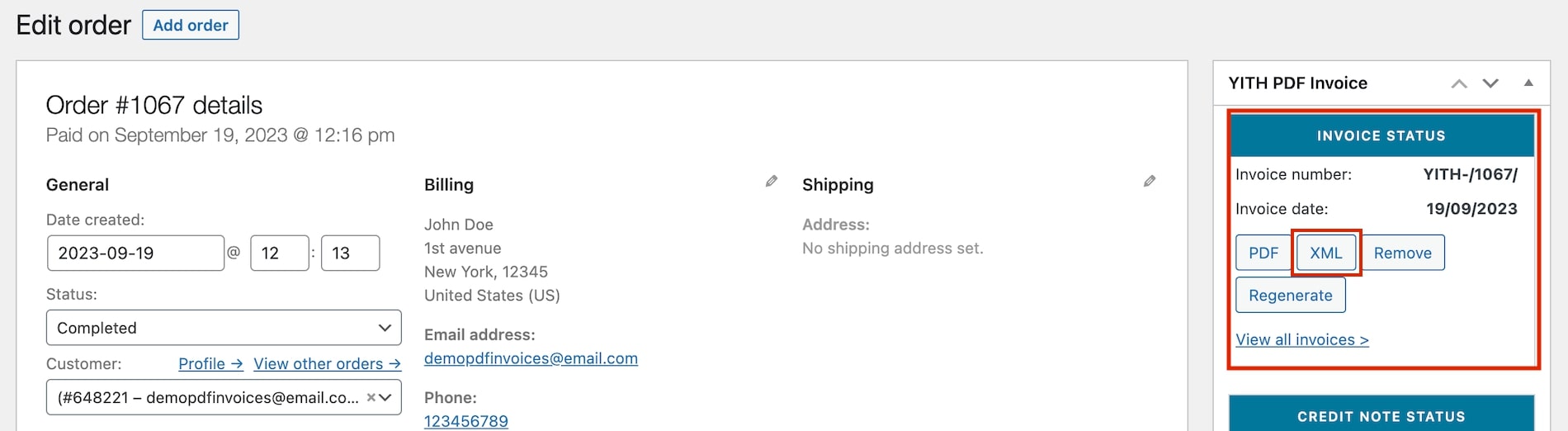

Download the .XML file

Now, if you have configured all the other settings for the generation of automatic invoices, whenever a new invoice is generated also the .xml file will be generated. You can see it on the right side, in the box Invoice status.

Click on the XML button to download the file.

Please, note: if you can’t see the .XML button in the order details, make sure to disable the option for the preview (YITH > PDF Invoices & Packing Slips > Preview Mode), because the .XML file cannot be generated out of a preview.