The new European Union tax regulations, with the OSS procedure, establish two ways to apply VAT for companies selling products online within the European Union:

- if the sale threshold is under €10,000 per year, it is possible to apply the store registered country’s VAT rules;

- if the sale threshold is above €10,000 per year, the VAT applied will be the one of the customer’s country.

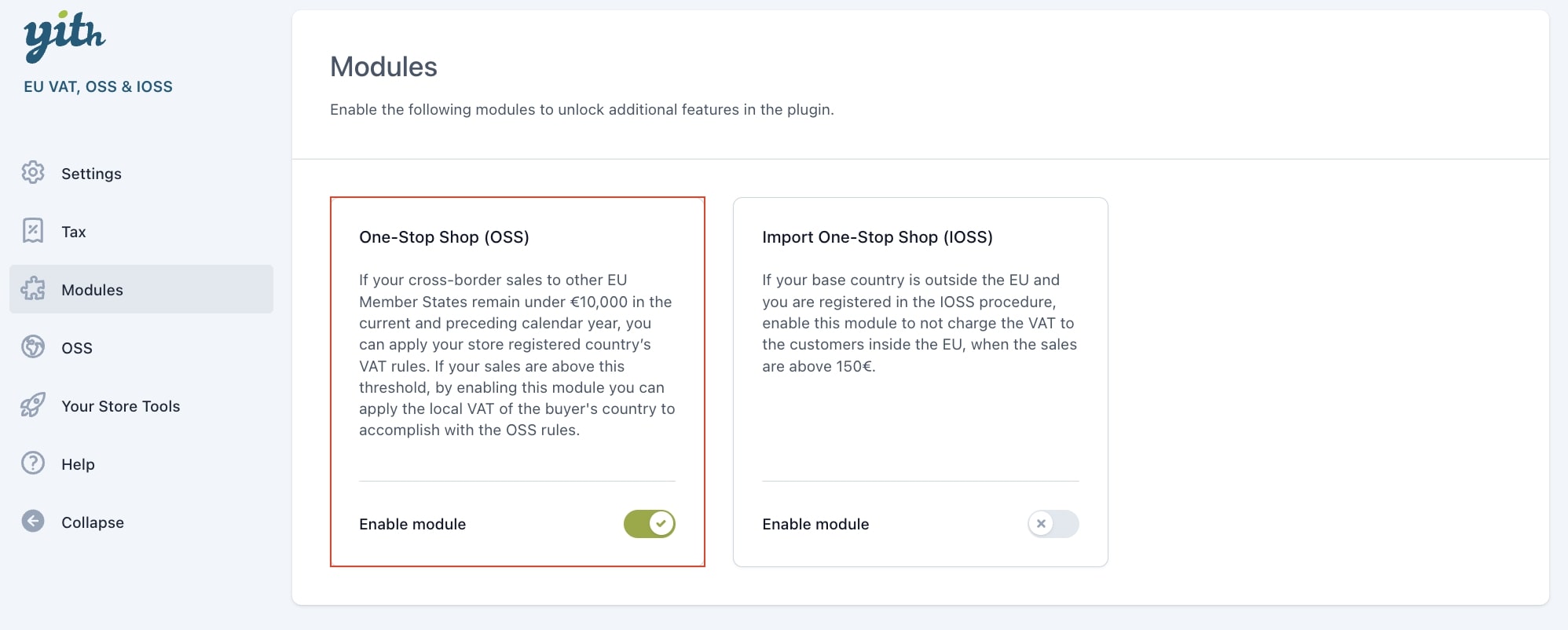

To apply the One-Stop Shop procedure, you must first enable the module One-Stop Shop (OSS).

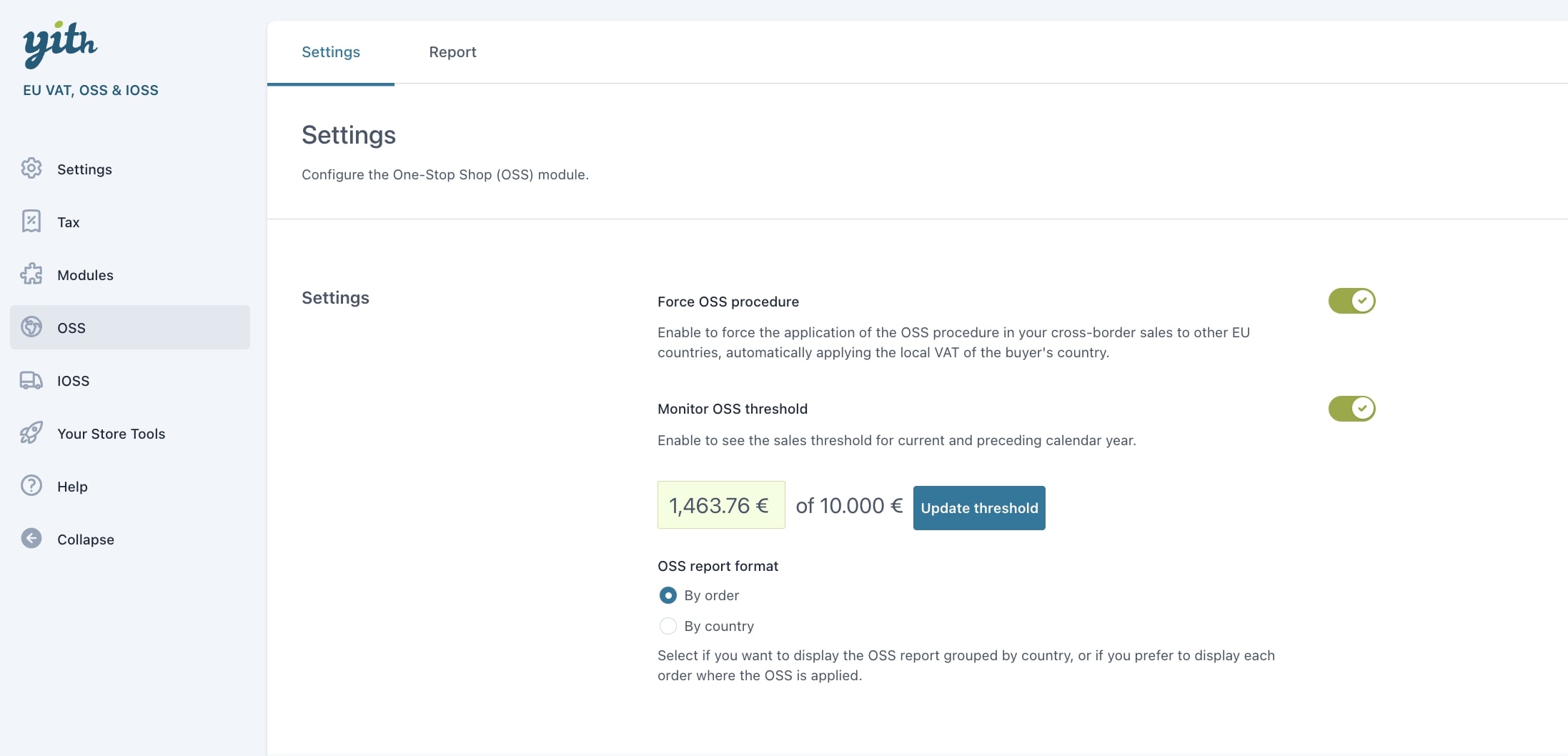

Now go to the OSS > Settings section where you can find the following options:

- Force OSS procedure: enable this option to apply the OSS procedure without the need to comply with the 10.000€ threshold limit. The OSS procedure will be applied to sales to EU countries and the VAT will be automatically applied based on the user’s country.

- Monitor OSS threshold: enable this option to track the threshold of the current and previous year. If, for any reason, you need to check again the orders placed, you can click on the button Update threshold.

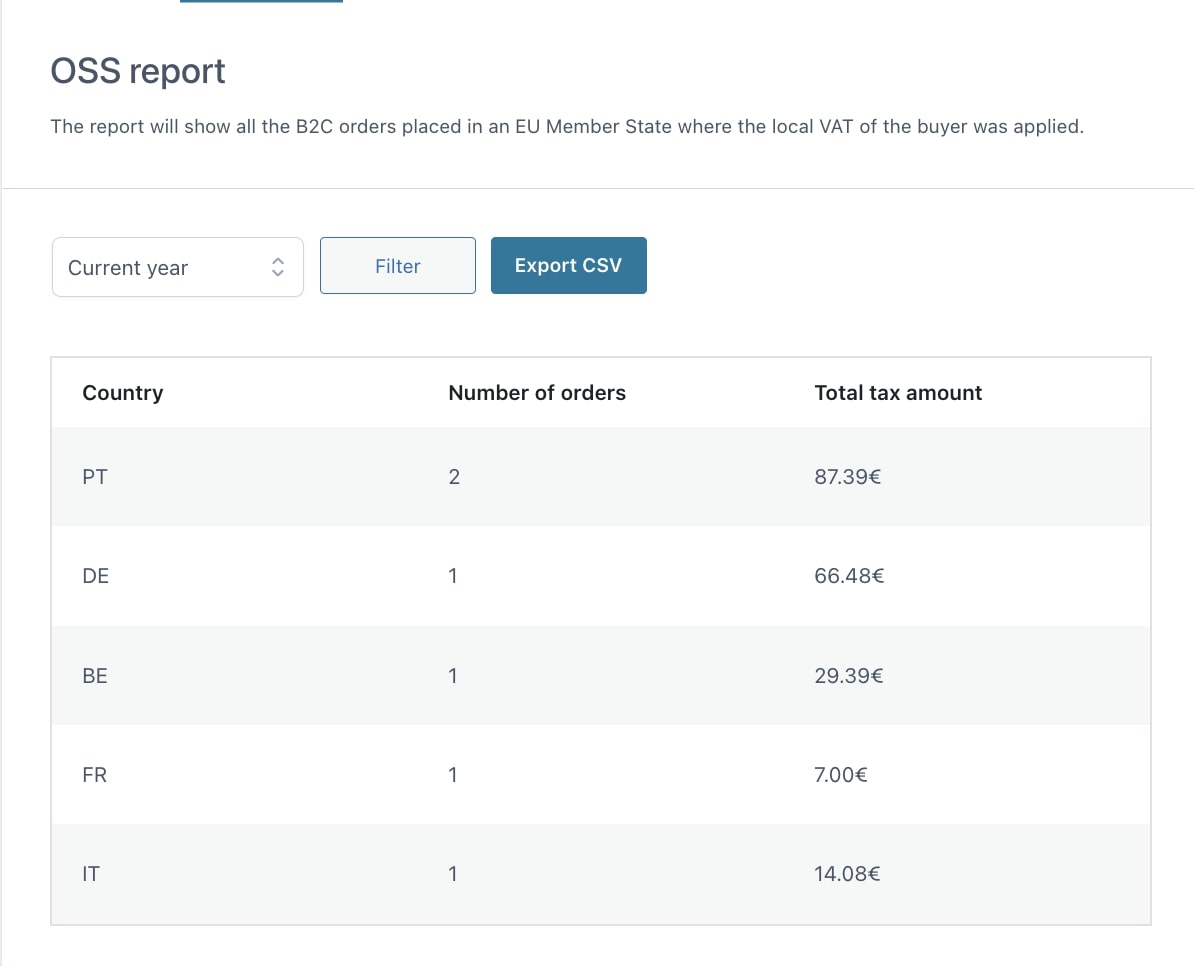

- OSS report format: you can view the OSS report by orders to which the OSS has been applied or by country.

For more details about the OSS rules, please, refer to the official website of the European Union here.

Report

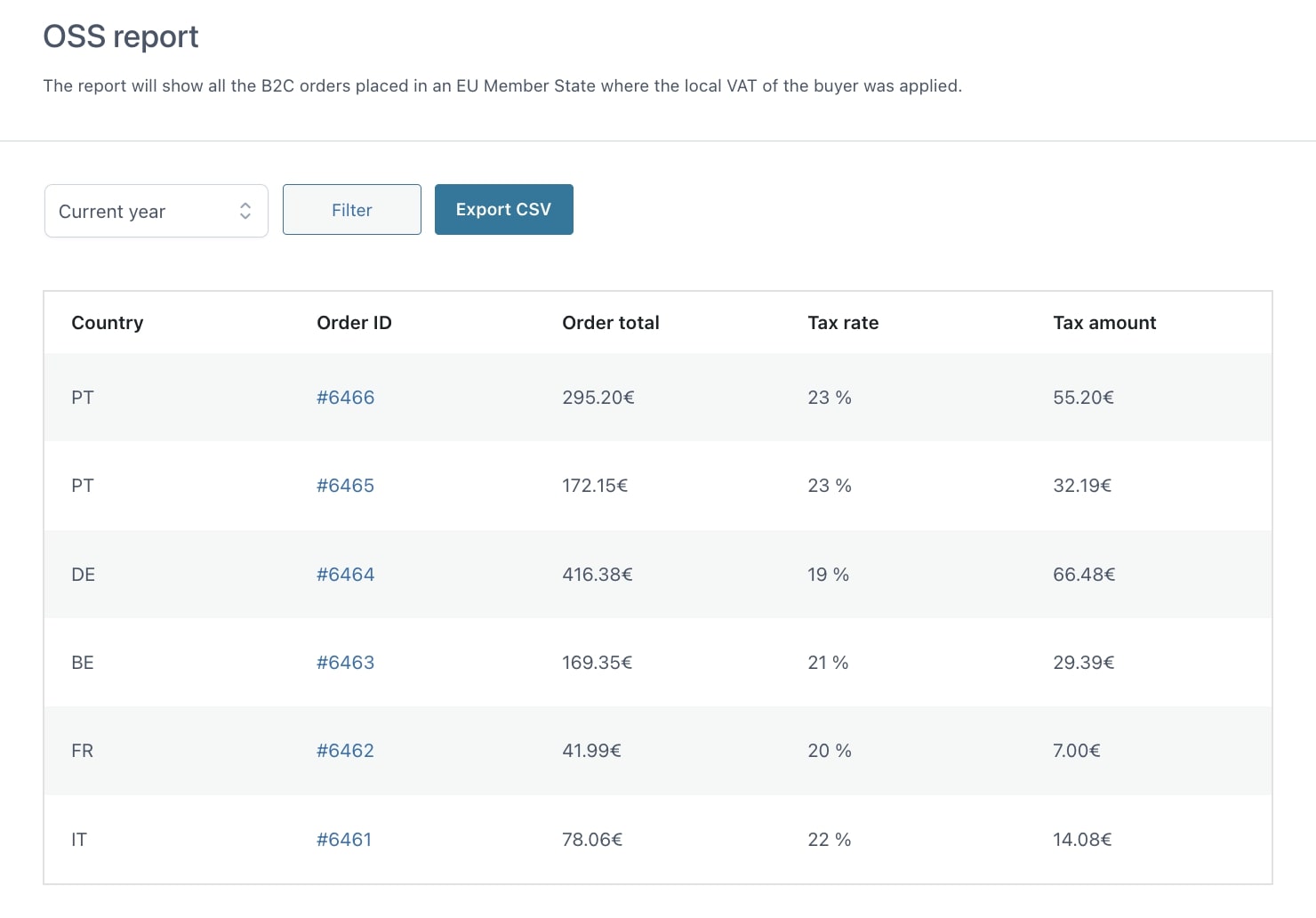

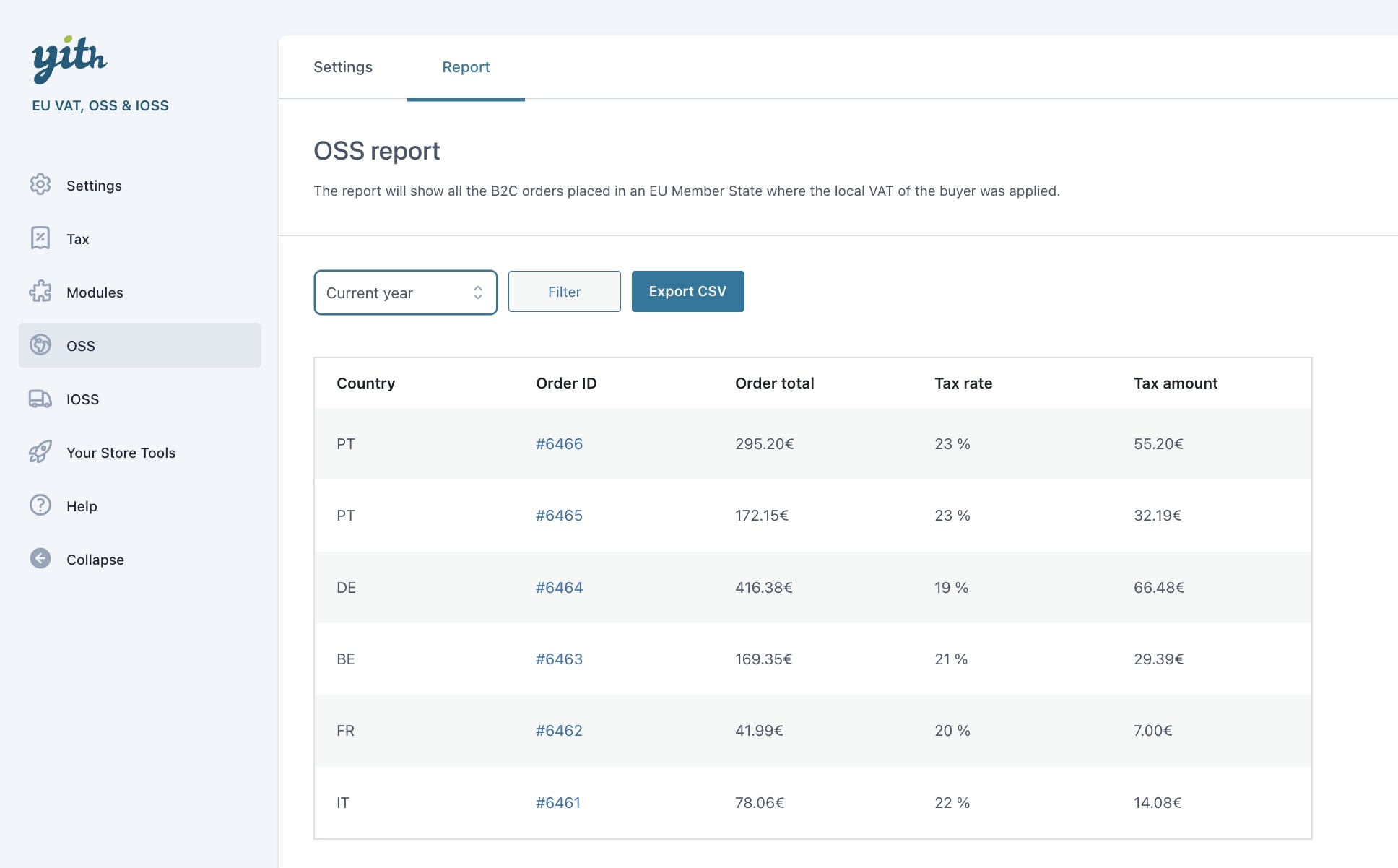

The plugin tracks all the B2C orders originated by the European Union countries (excluding the shop base country) with the total number of orders and the total amount of taxes for each one in detail.

To access the OSS report go to the section OSS > Report.

The report table shows the user’s country, order ID, order total, tax rate, and tax amount.

Filter report

You can also filter reports by current year, current month, last month, last 3 months, last 6 months, last year, or custom date ranges.

Based on what selected in the option OSS report format, the report will show by order or by country.

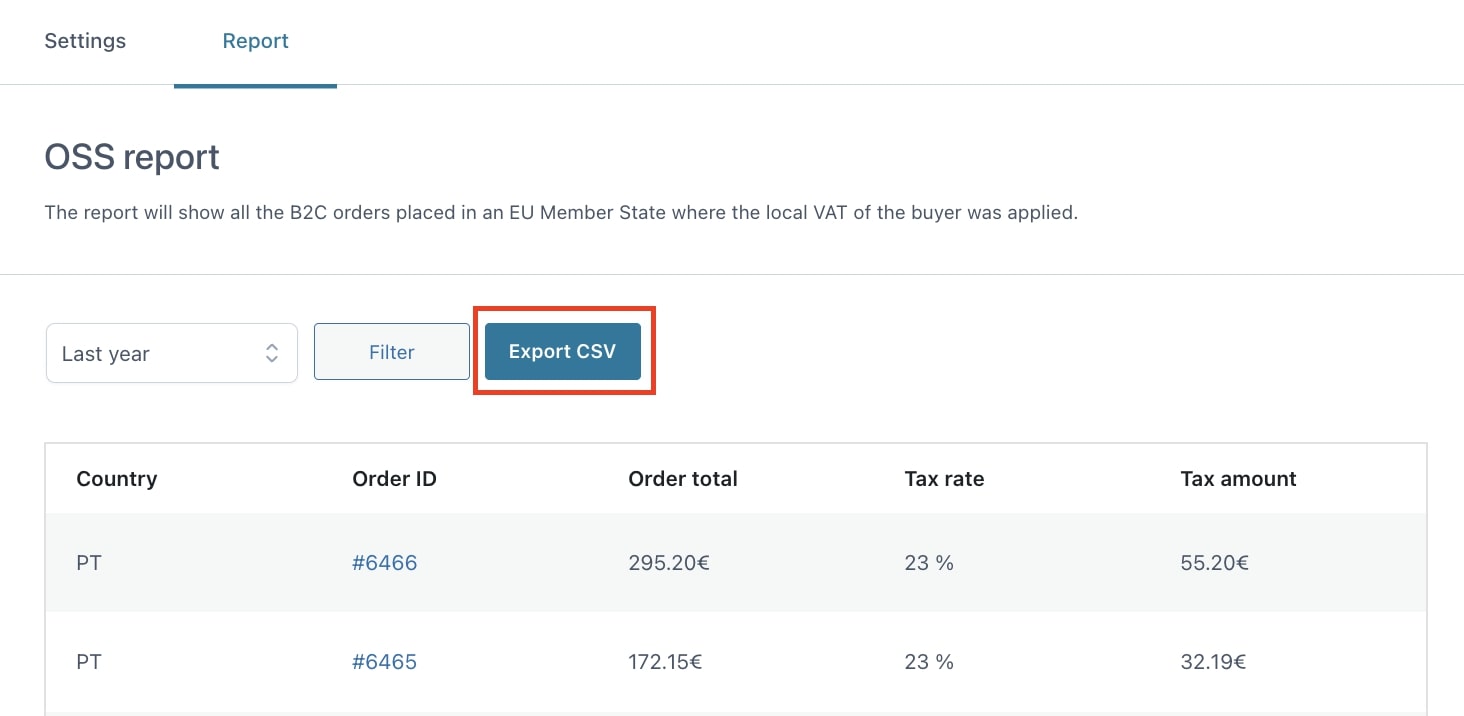

Export report

From this section, you can also export the reports into a CSV file by clicking on Export CSV.