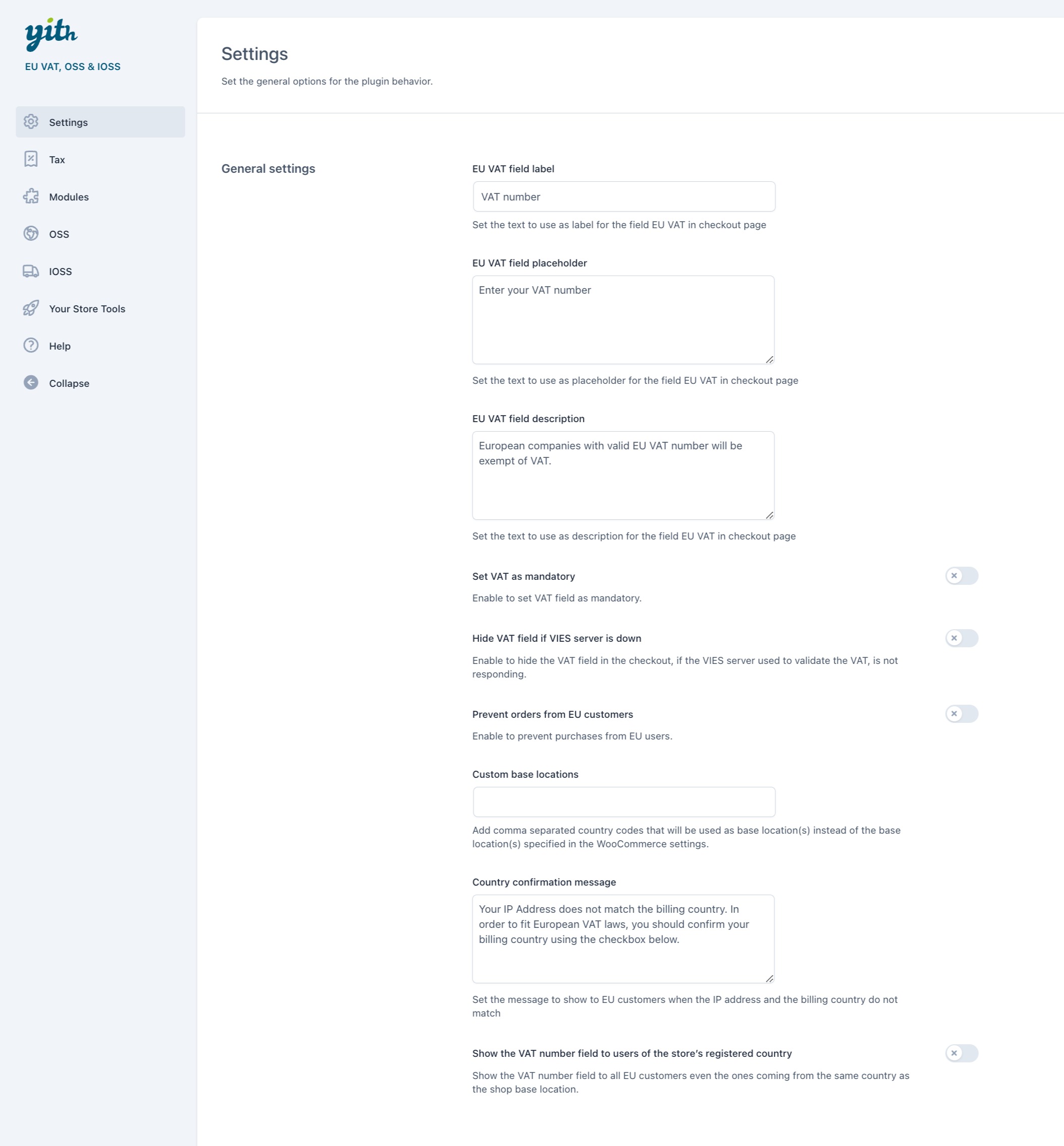

You can set up all the plugin options from the section General settings.

Let’s see how to configure these options:

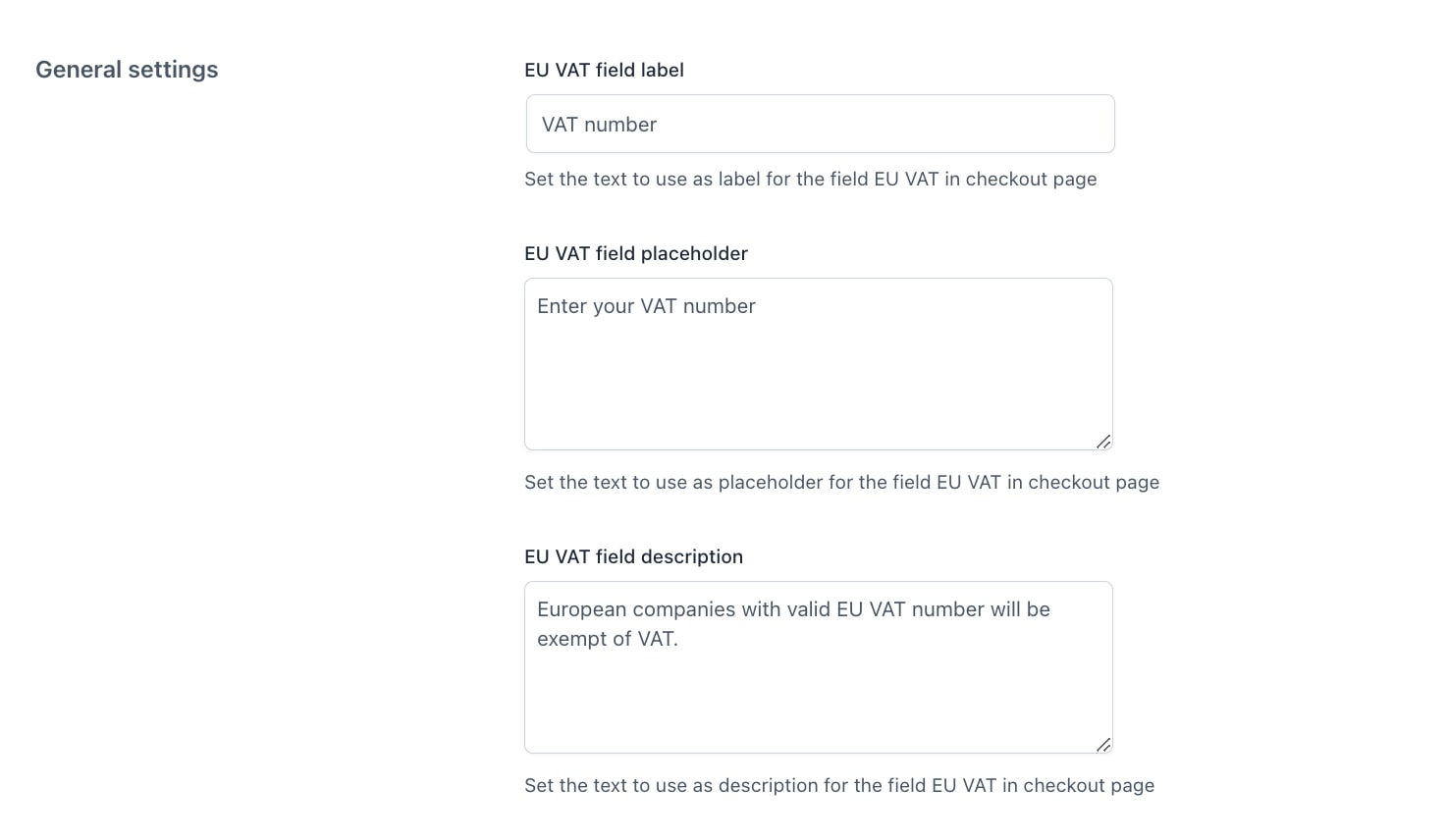

- EU VAT field label: enter the text for the EU VAT field shown on the checkout page.

- EU VAT field placeholder: enter the text to use as a placeholder for the EU VAT field on the checkout page.

- EU VAT field description: enter the text to use as a description for the EU VAT field on the checkout page.

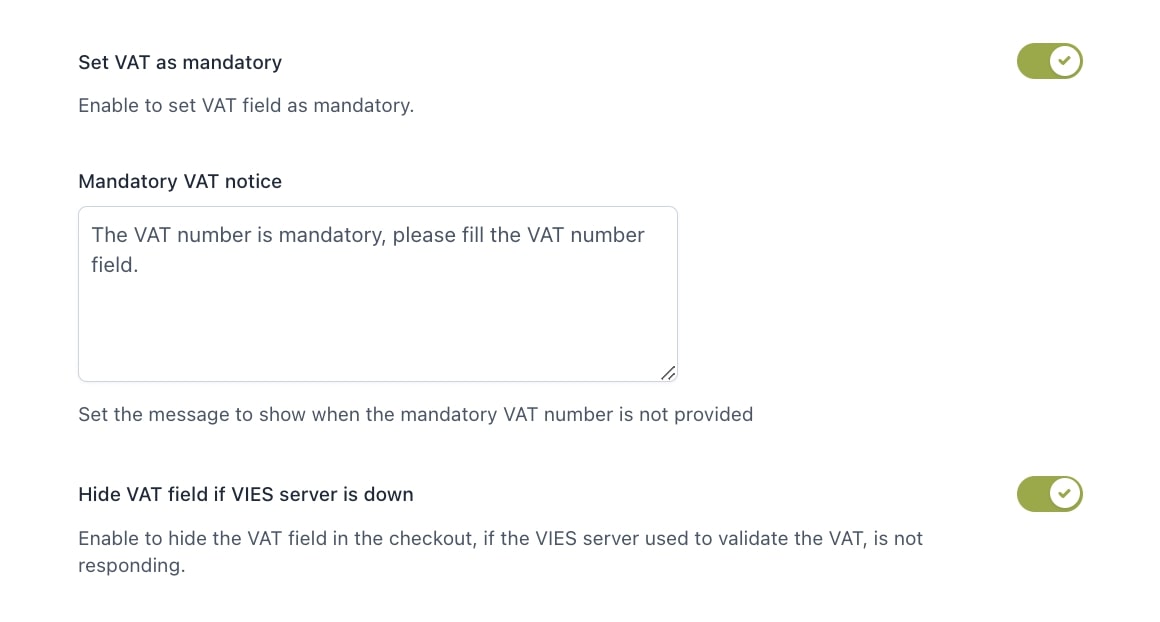

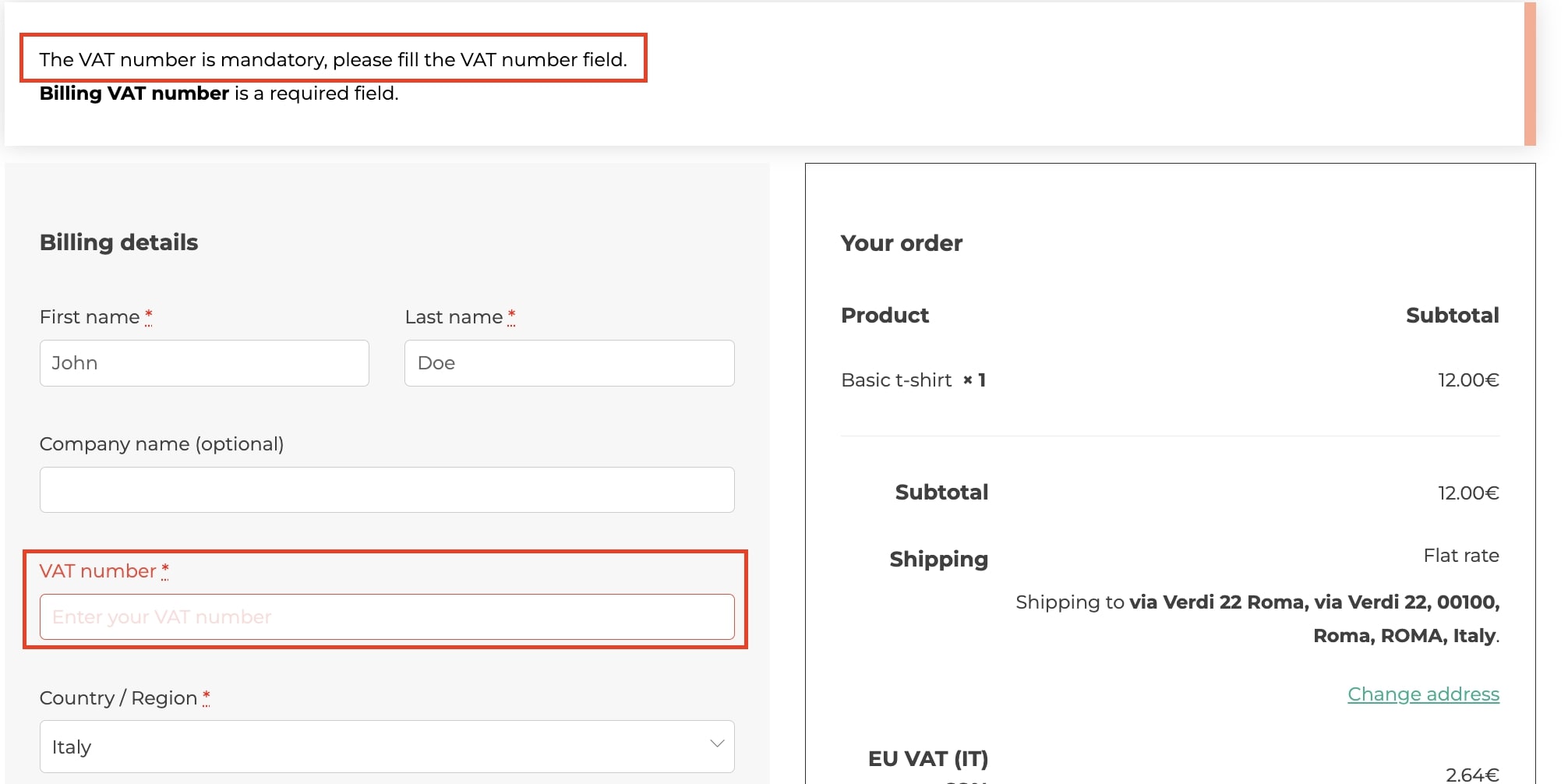

- Set VAT as mandatory: if enabled, the VAT field will be required and users will need to complete it.

- Mandatory VAT notice: enter the text to show as a message to users who don’t complete the required VAT field.

- Hide VAT field if VIES server is down: by enabling this option, the VAT field will be hidden in the checkout if the VIES server used to validate the VAT is not responding.

Mandatory VAT on Checkout page

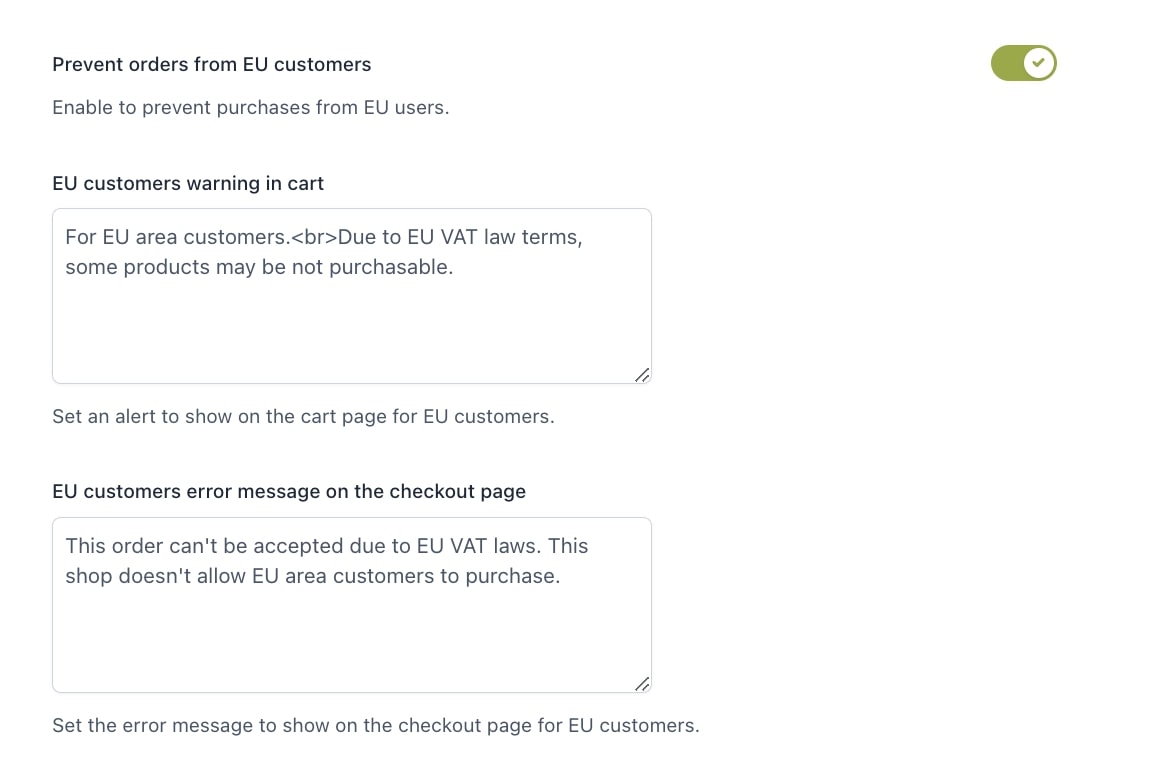

- Prevent orders from EU customers: enable this option if you want to prevent European customers from placing orders in your shop.

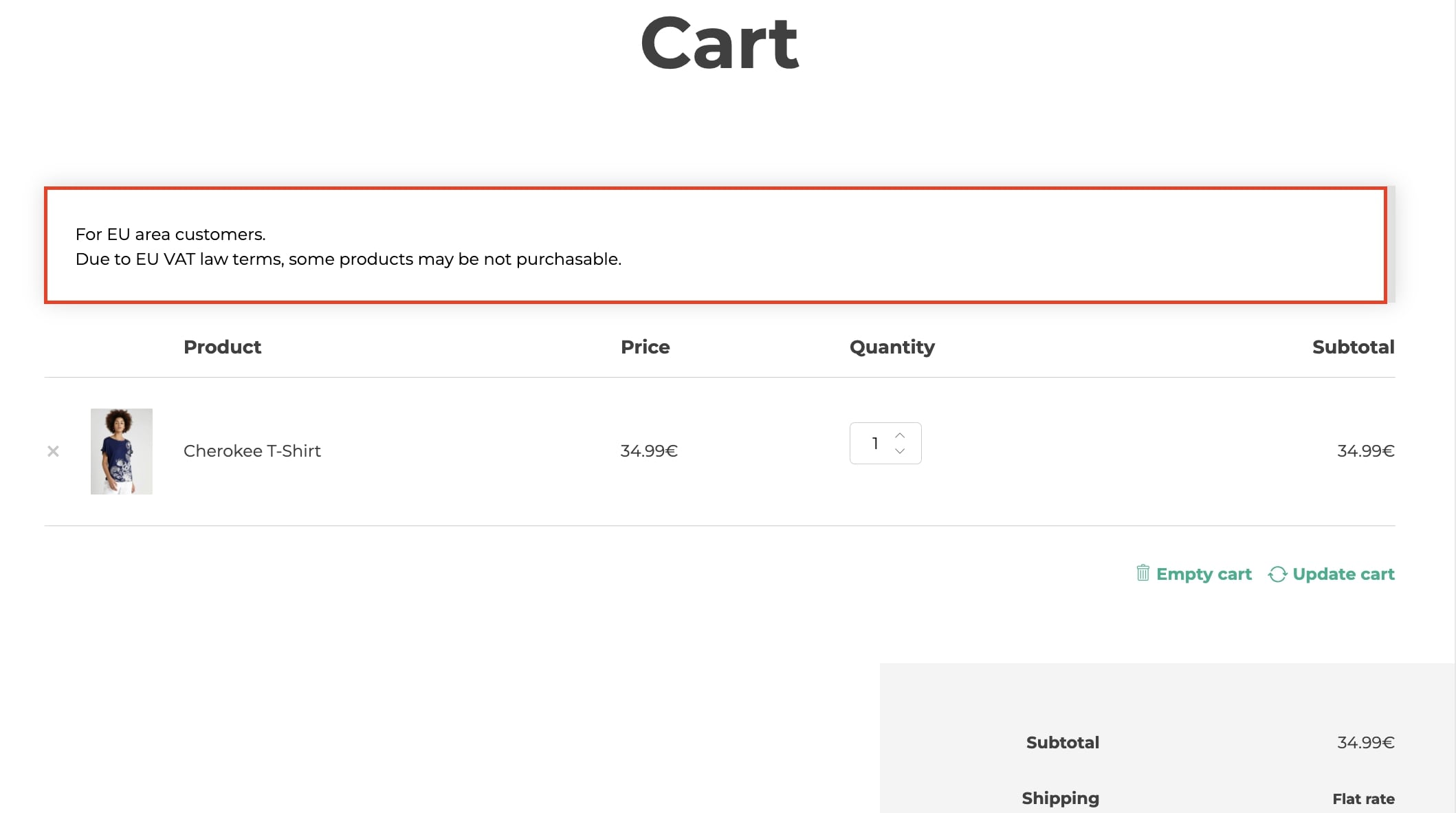

- EU customers warning in cart: you can choose to show a warning message on the cart page to notify EU customers about the impossibility of completing their purchase.

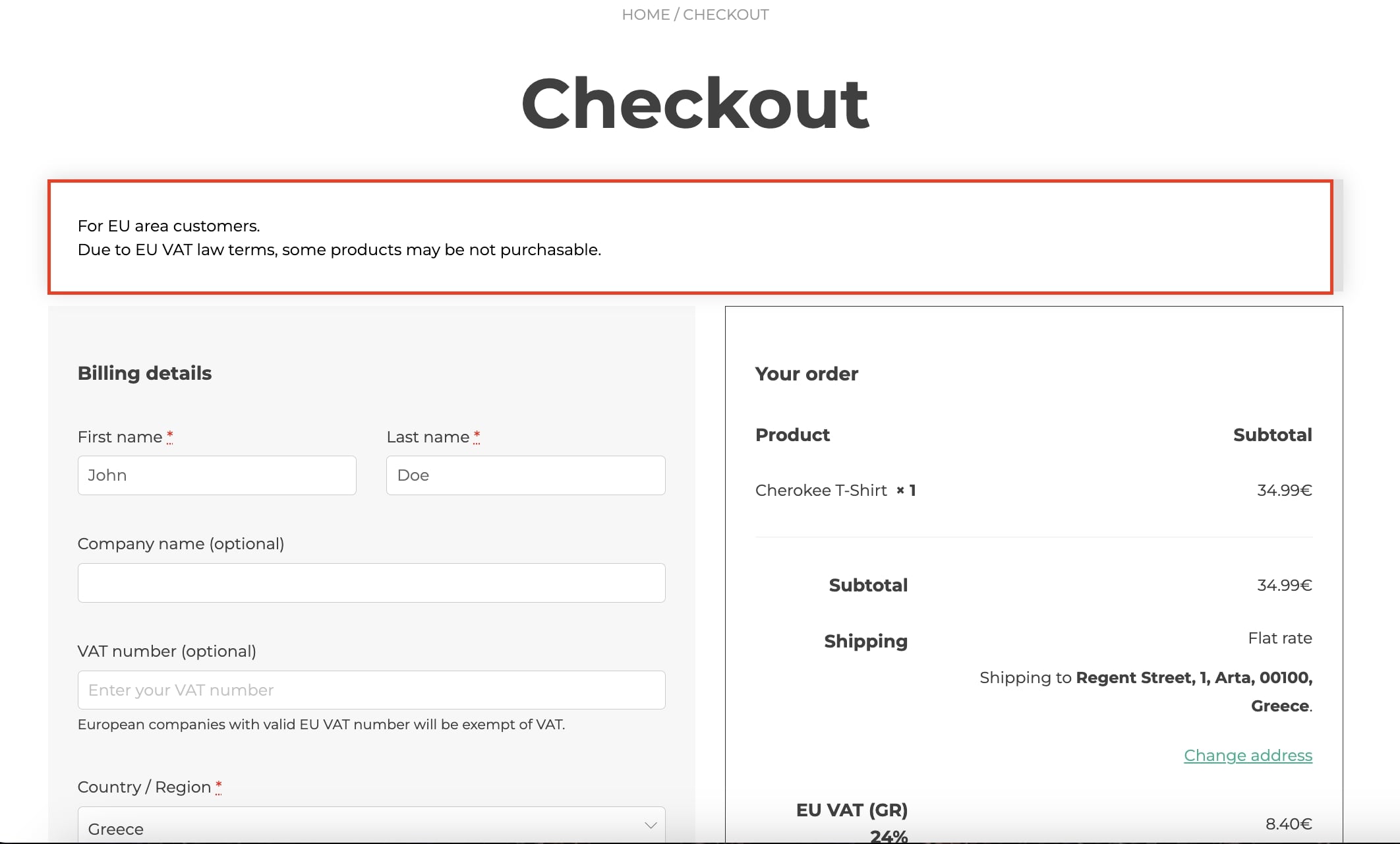

- EU customers error message on the checkout page: you can choose to show a warning message on the checkout page to notify EU customers about the impossibility of completing their order.

Message on Cart page

Message on Checkout page

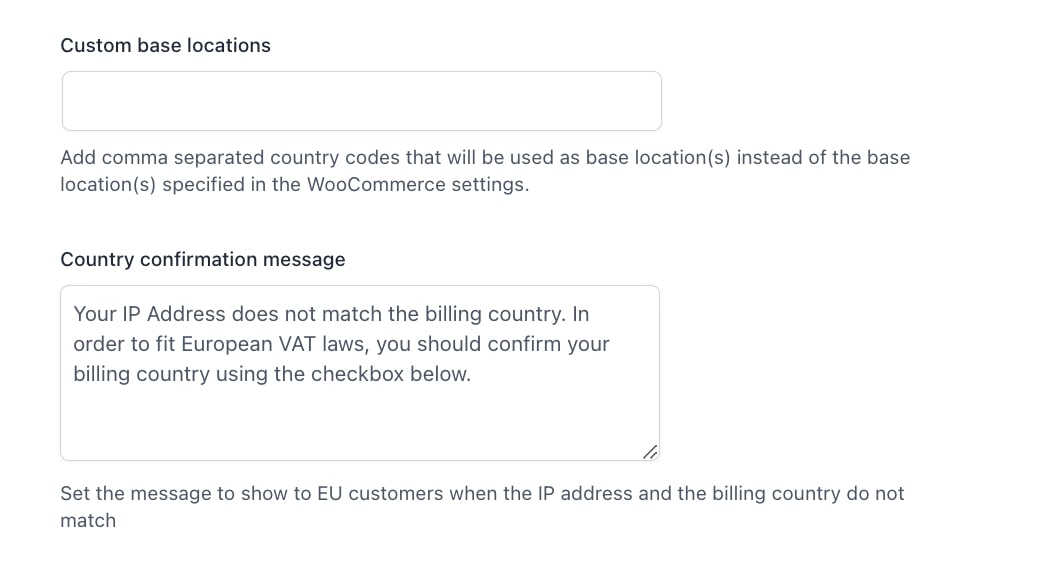

- Custom base locations: here, you can add country codes (comma separated) that will replace base location(s) specified in WooCommerce settings. Since the VAT applies if the user’s country is the same as the base location, you can extend this feature also to more than one country.

Companies from European countries enabled through this option can insert their VAT number in the checkout page and, after validating the field, won’t pay the TAX for the order.

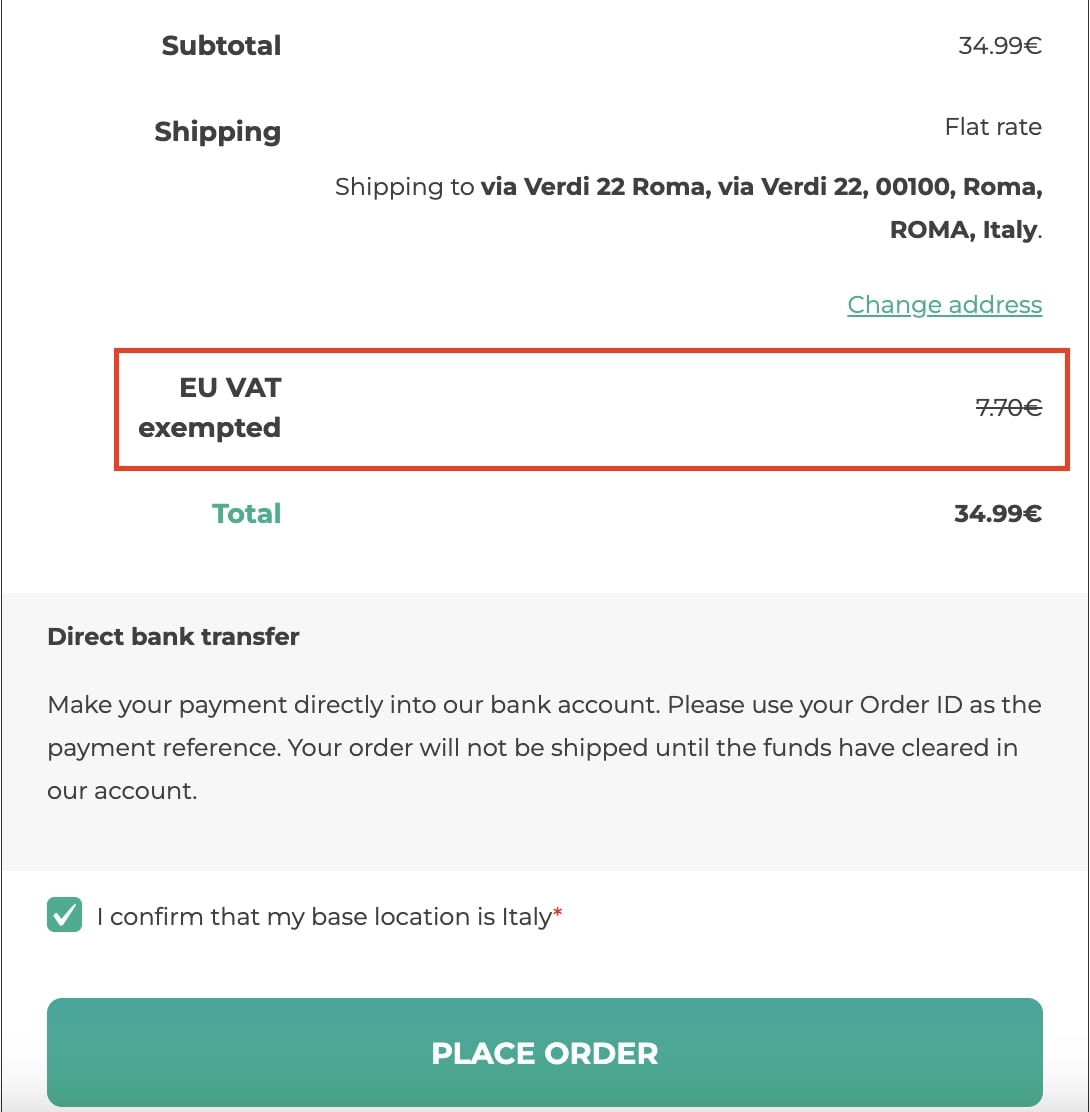

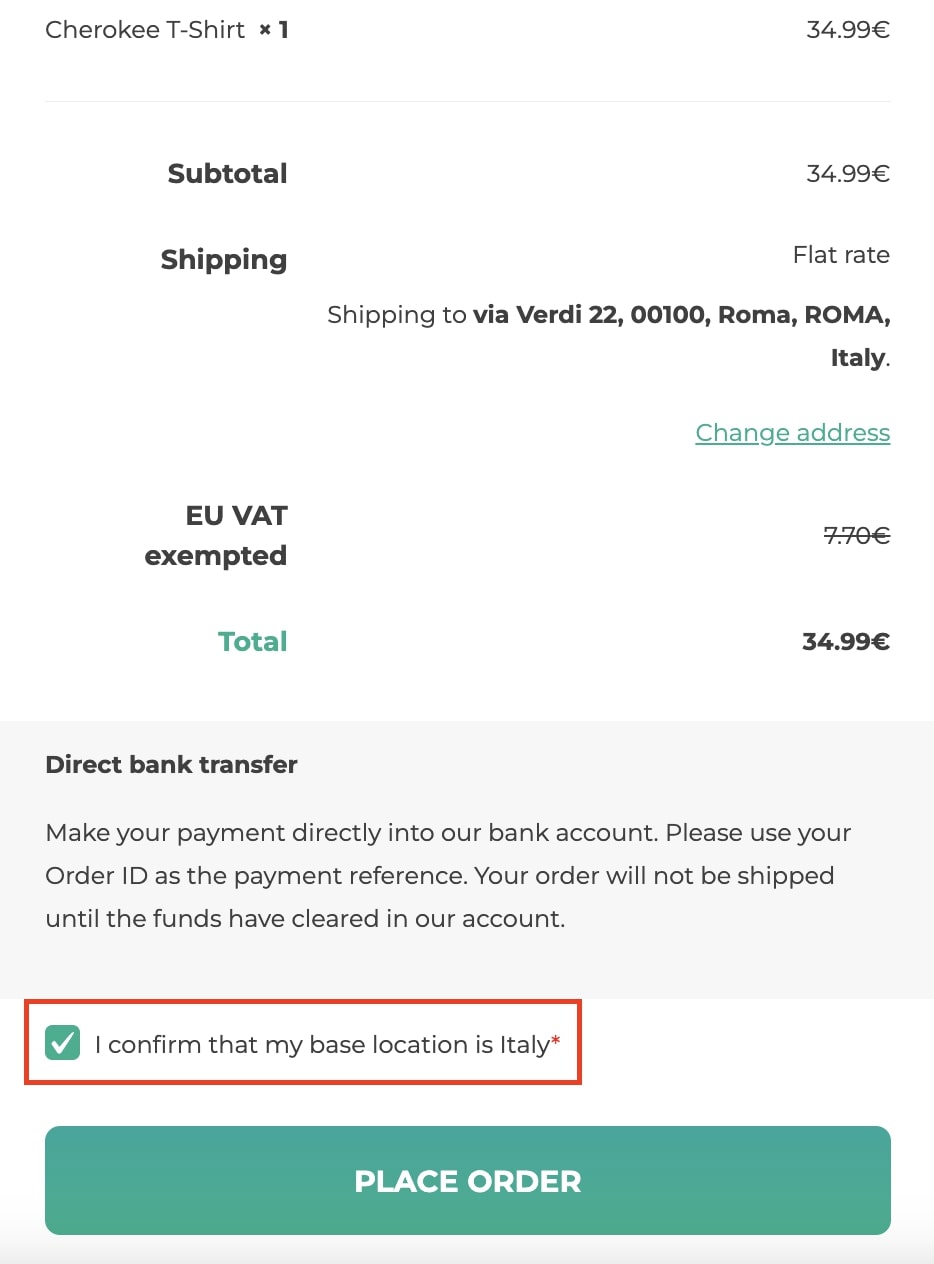

- Country confirmation message: here, you can configure the message to show to EU customers when the IP address and the billing country do not match. The related checkbox will be added to the end of the checkout process.

Checkbox on Checkout page

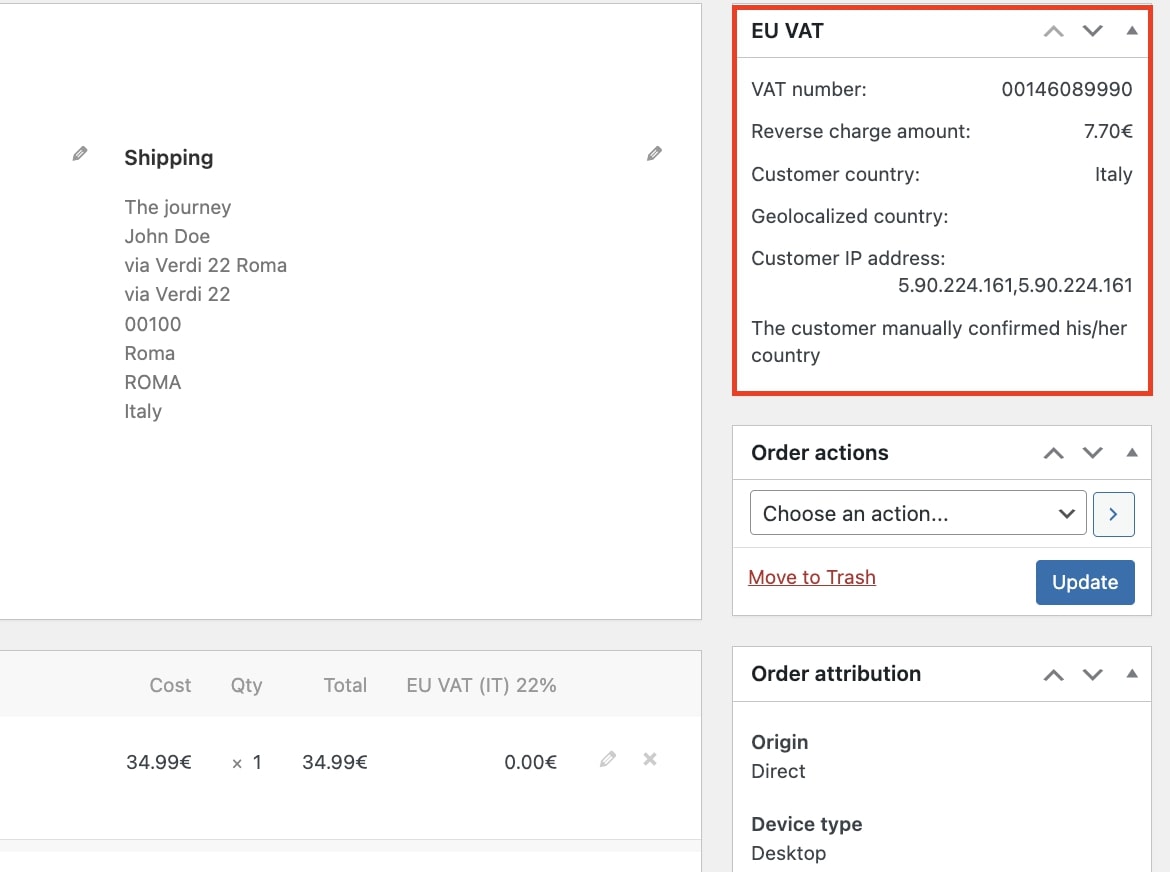

The data are saved on the order detail page.

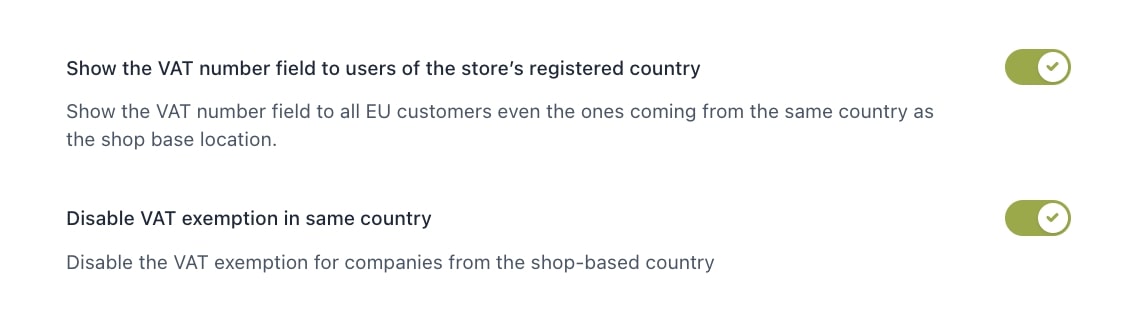

- Show the VAT number field to users of the store’s registered country: if enabled, the VAT number field will show to all EU customers, even those from the same country as the shop base location.

- Disable VAT exemption in same country: if enabled, it deactivates VAT exemption in calculating totals for the same country.