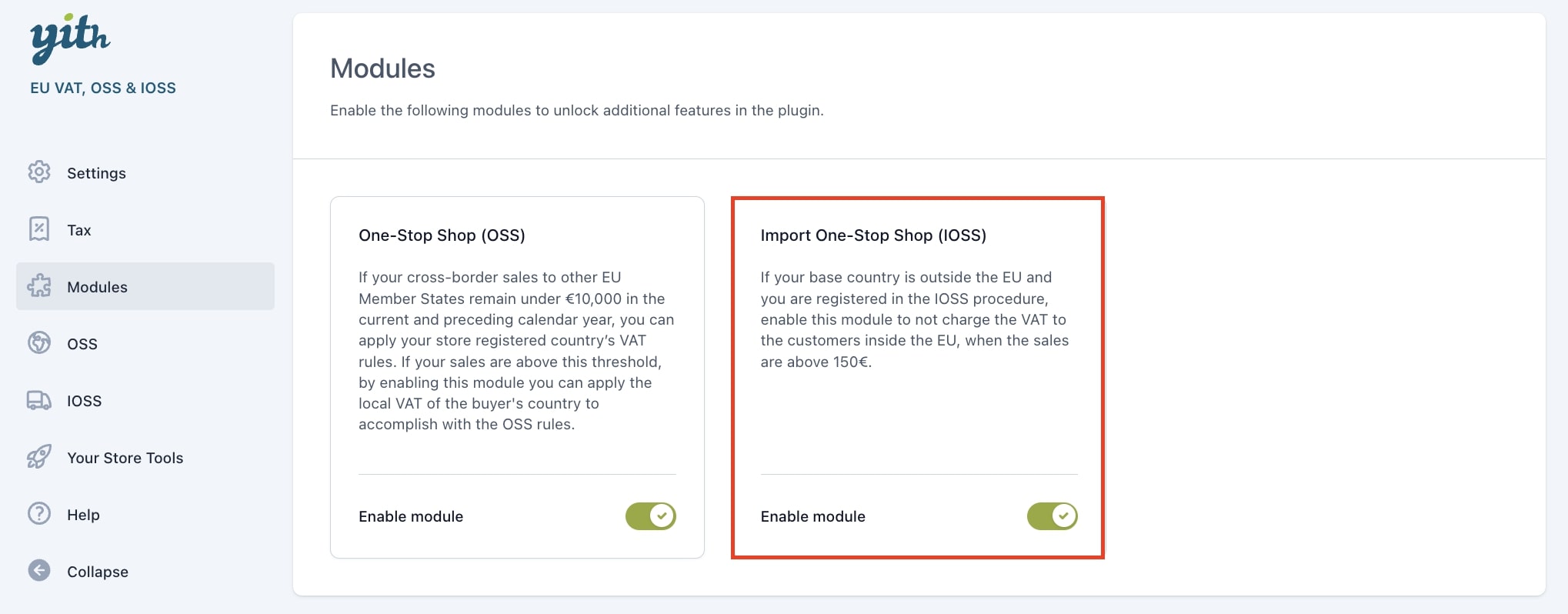

The Import One-Stop Shop (IOSS) module is expressly for the use of companies/shops based outside the European Union (EU) selling their physical goods to European customers. EU customers who purchase from the non-EU shop will be VAT exempted if the order total is above the 150€ threshold.

To apply the Import One-Stop Shop procedure, you must first enable the module Import One-Stop Shop (IOSS).

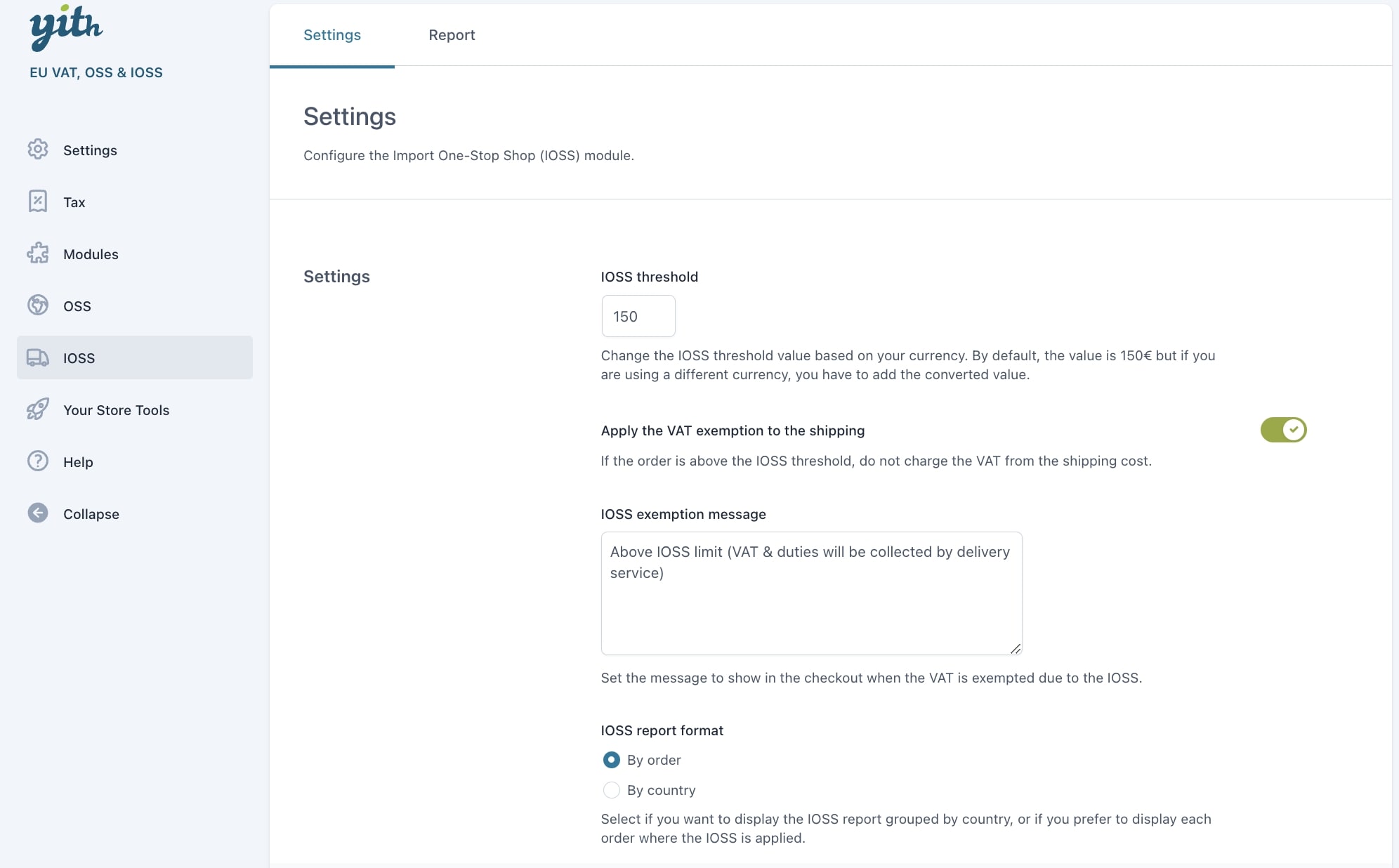

Now go to the IOSS > Settings section where you can find the following options:

- IOSS threshold: this option allows changing the default threshold value (€150) into the converted value based on the currency used if different from euros.

- Apply the VAT exemption to the shipping: enable this option not to charge VAT for shipping if the order exceeds the IOSS threshold.

- IOSS exemption message: enter the text to show to customers as a VAT exemption at the checkout.

- IOSS report format: you can view the OSS report by order to which the IOSS has been applied or by country.

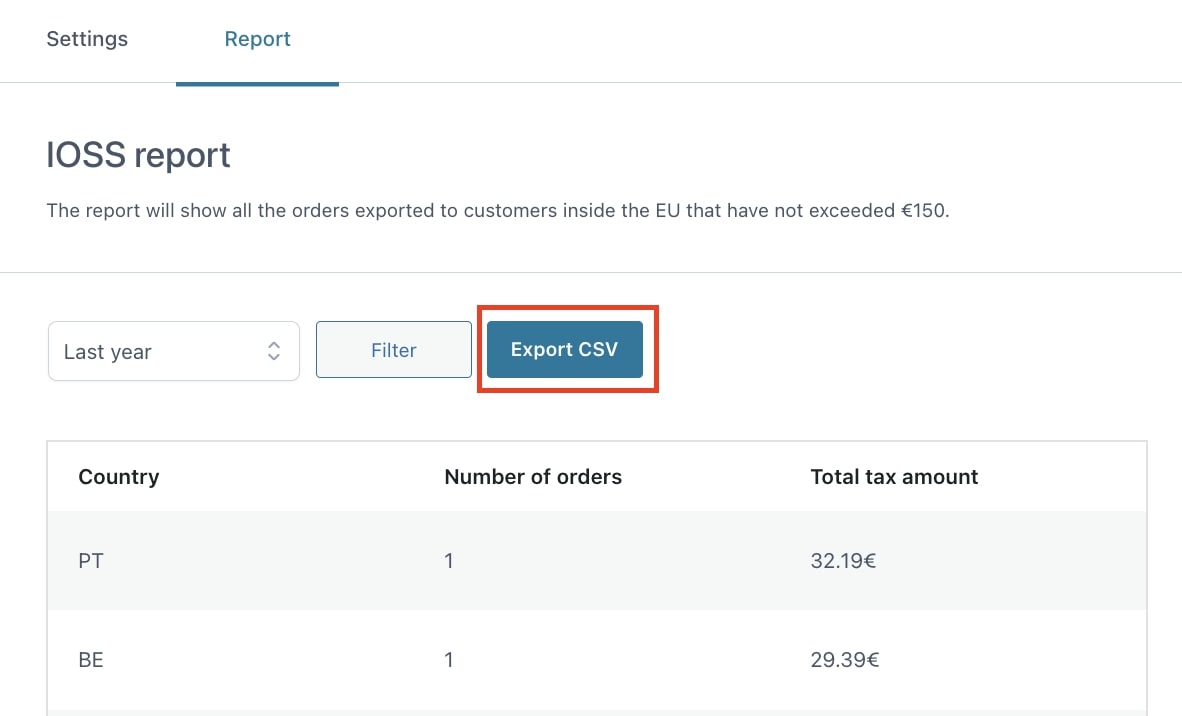

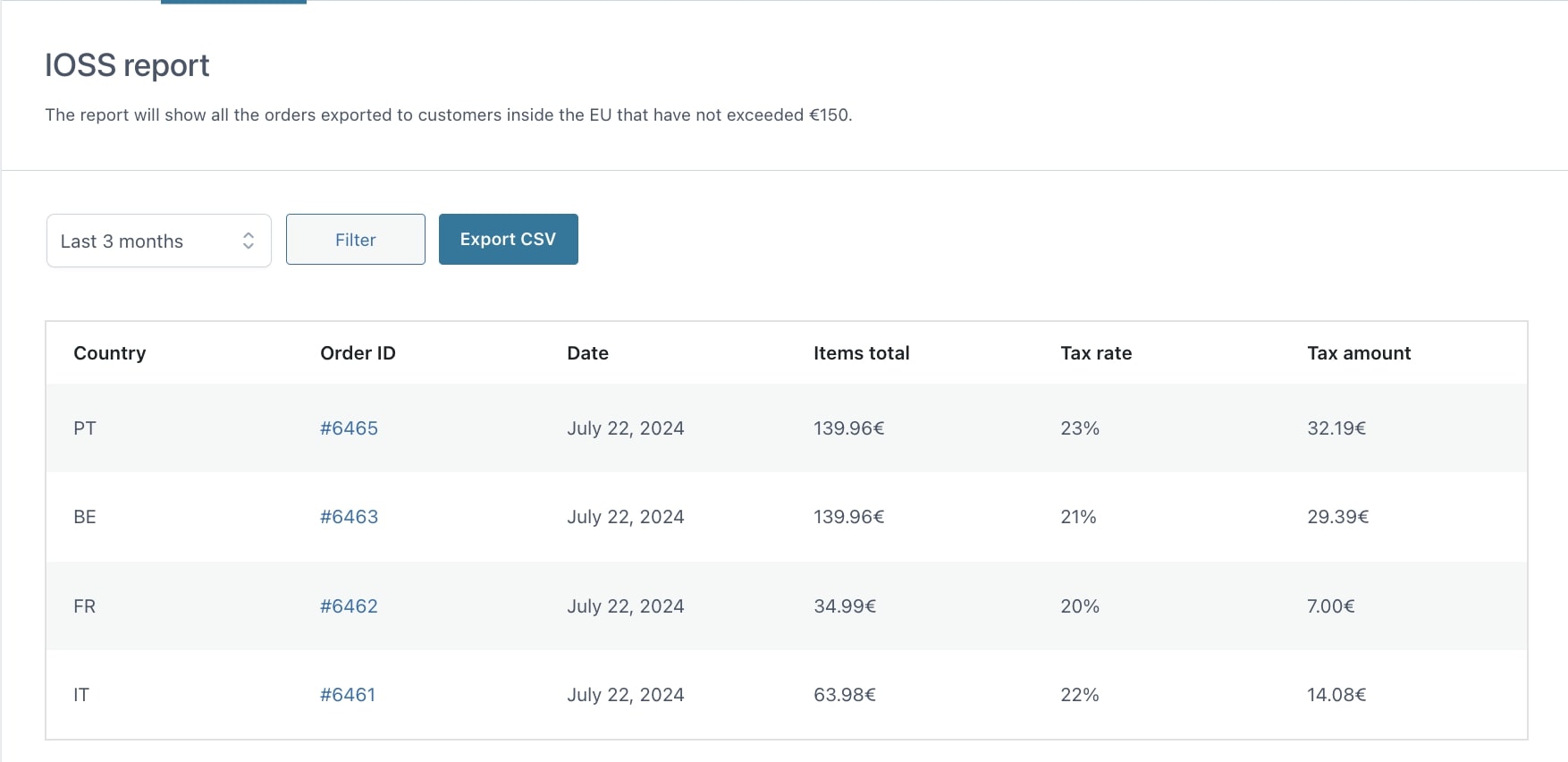

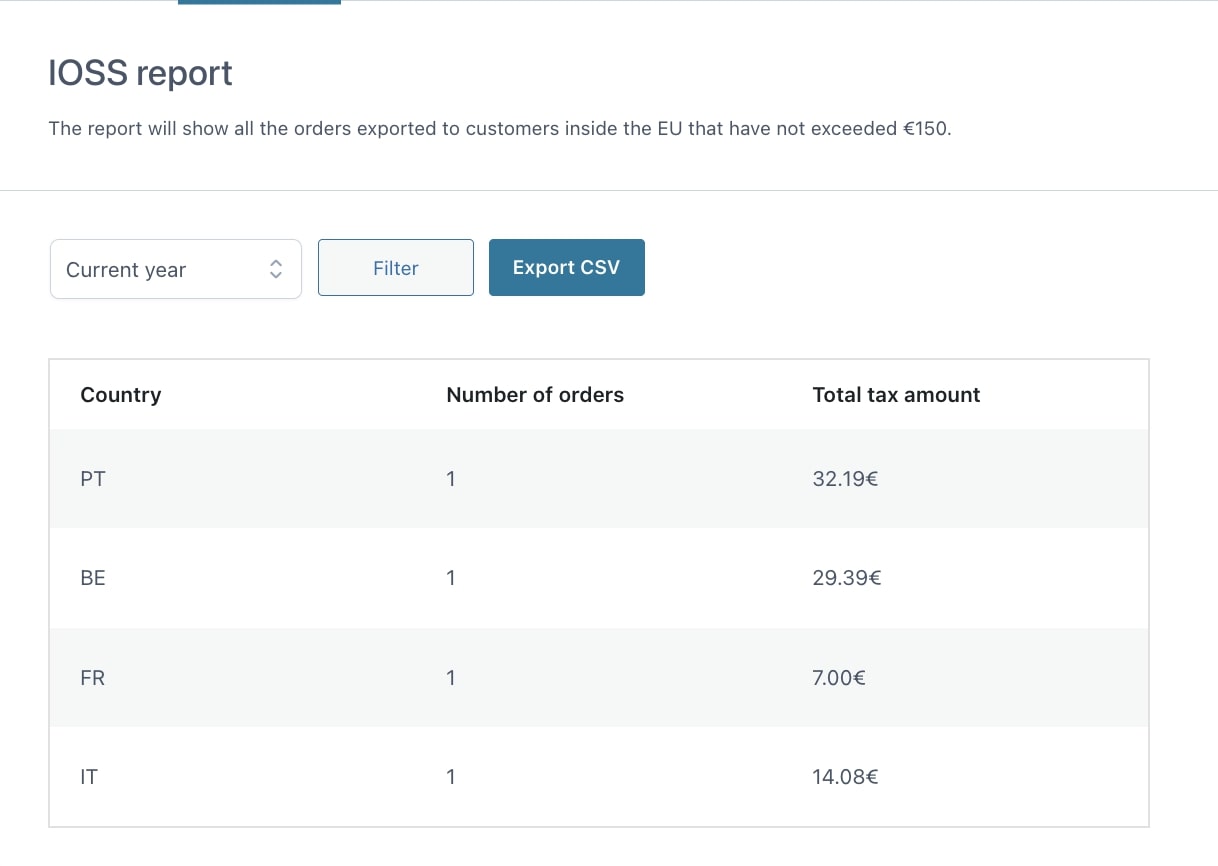

Report

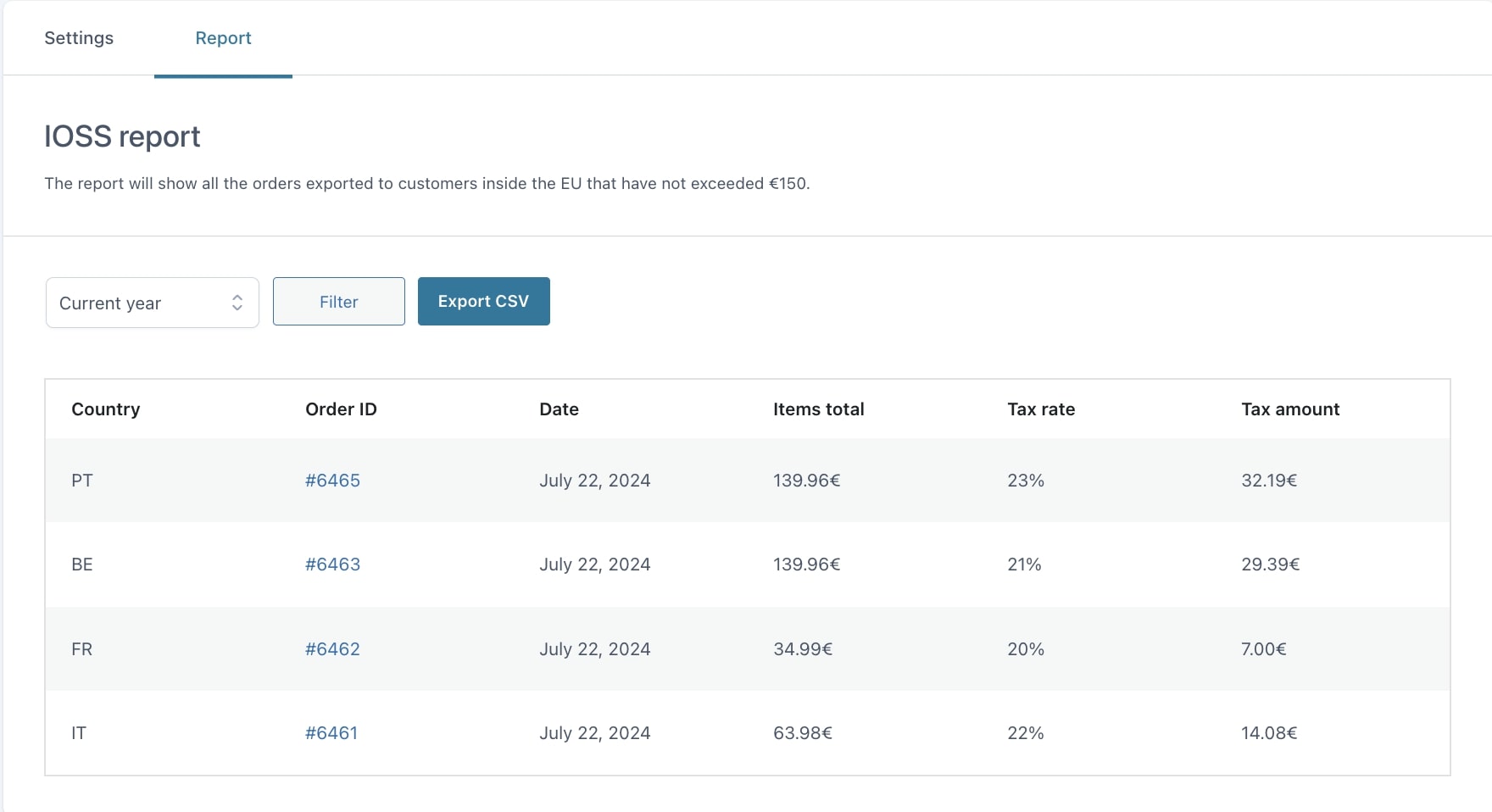

The plugin tracks all the orders originated by the European Union countries with the total number of orders and the total amount of taxes exempted for each one in detail.

To access the IOSS report go to the section IOSS > Report.

The report table shows the user’s country, order ID, items total, tax rate, and tax amount.

Filter report

You can also filter reports by current year, current month, last month, last 3 months, last 6 months, last year, or custom date ranges.

Based on what selected in the option OSS report format, the report will show by order or by country.

Export report

From this section, you can also export the reports into a CSV file by clicking on Export CSV.